The Nonprofits Insurance Alliance of California Inc. (NIA) has made a significant decision to halt the renewal of specific insurance coverages for foster family agencies (FFAs) in California. This decision directly responds to new state legislation, Assembly Bill 2496, signed by Governor Gavin Newsom on September 22, 2024. The bill modifies the process for transferring resource home approval to make it less stringent, causing concerns within the insurance industry. NIA, a crucial provider of insurance for FFAs, will discontinue renewing directors and officers (D&O) liability, social services professional liability, and improper sexual conduct and physical abuse liability coverages. Despite this change, NIA will continue to offer commercial automobile, general liability, and property coverage without interruption.

Impact of Assembly Bill 2496

Changes in Resource Home Approval Process

Assembly Bill 2496 introduces significant modifications to the resource home approval process, which now features a less stringent vetting procedure. This relaxation aims to expedite the placement of children into foster homes but has raised concerns among insurance providers like NIA. Pamela Davis, NIA’s founder, president, and CEO, has expressed apprehension that this reduced vetting process could lead to increased legal challenges. She fears the weaker system could be exploited, attributing potential negligence in cases of abuse or injury to the lesser scrutiny of resource homes, thus inflating legal risks and insurance claims. This scenario creates an unpredictable and risky environment for insurers, who must weigh the potential costs against maintaining coverage offerings.

The legislation also implies that FFAs and public entities bear the responsibility of their insurance costs and defend against any claims that arise due to their actions or negligence. With the legal landscape becoming increasingly litigious, insurance companies are finding it difficult to provide comprehensive coverage without destabilizing their financial foundations. Large jury awards and an uptick in legal challenges within the foster care system underscore an overarching trend: an increasing financial burden placed on FFAs. The new bill exacerbates this issue by not addressing these escalating costs, leaving FFAs more vulnerable to inflated claims and requiring them to allocate more resources toward combating legal battles.

Legislative Ripple Effects on Insurance Coverage

The decision by NIA to cease renewing specific coverages underscores a broader trend influenced by legislative changes. By halting renewals for D&O liability, social services professional liability, as well as improper sexual conduct and physical abuse liability, NIA aims to manage its risk better and protect the stability of its overall portfolio of policyholders. This move, though challenging for FFAs, is seen as a necessary step to shield over 12,000 policyholders, including a wide range of nonprofit organizations that rely on NIA for their insurance needs. Among them are well-known entities such as Boys and Girls Clubs, homeless shelters, and senior centers.

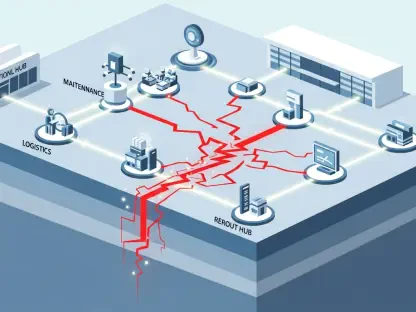

The legislation’s ripple effects manifest in how insurers must constantly adjust their coverage terms and availability to reflect the evolving legal and regulatory landscape. NIA’s decision reflects the balancing act insurers must perform—offering essential coverage while ensuring their financial health remains unscathed. Legal pressures and sizeable jury awards continue to influence policy terms, pushing insurance companies to make tough choices to safeguard their operational viability. The complexity of the insurance market for nonprofit organizations is underscored by this recent decision, where each legislative adjustment has far-reaching implications for coverage availability.

Broader Implications for Nonprofits

Balancing Coverage and Financial Stability

NIA’s decision to discontinue certain coverages for FFAs highlights the delicate balance insurers must maintain between offering coverage and protecting their financial stability. The new California legislation imposes additional responsibilities on FFAs and public entities, mandating that they shoulder their insurance costs and defend against claims independently. This adds another layer of complexity and financial strain on these agencies, which are already dealing with significant operational challenges. The move by NIA reflects a broader industry trend where insurers continuously re-evaluate their coverage portfolios in response to legislative changes and legal pressures.

Insurance providers face an increasingly challenging landscape, where they must adapt to protect their financial health while offering necessary coverage to client organizations. Nonprofits, in particular, find themselves vulnerable as they rely heavily on insurance to continue their operations and mitigate risks. NIA’s decision is indicative of an industry keenly aware of the precarious nature of current legislations affecting its policyholders. The aim is to avoid a scenario where the legal environment becomes so prohibitive that insurers pull out entirely, leaving nonprofits without critical coverage.

Future Trends and Challenges

Assembly Bill 2496 brings notable changes to the resource home approval process, featuring a more relaxed vetting procedure. This shift aims to speed up placing children in foster homes but raises concerns among insurers like NIA. Pamela Davis, NIA’s founder, president, and CEO, worries that this softer vetting could lead to more legal challenges. She fears that the less stringent system might be exploited, causing negligence in abuse or injury cases, thereby boosting legal risks and insurance claims. This scenario creates an unpredictable landscape for insurers, who must balance potential costs against offering coverage.

The bill also implies that Foster Family Agencies (FFAs) and public entities will shoulder their insurance costs and handle claims arising from their negligence. With a more litigious environment, insurance companies struggle to provide comprehensive coverage without jeopardizing their financial stability. Large jury awards and rising legal challenges within the foster care system highlight a troubling trend: increasing financial burdens on FFAs. The new bill exacerbates this problem by failing to address these growing costs, making FFAs more susceptible to inflated claims and forcing them to allocate more resources to legal battles.