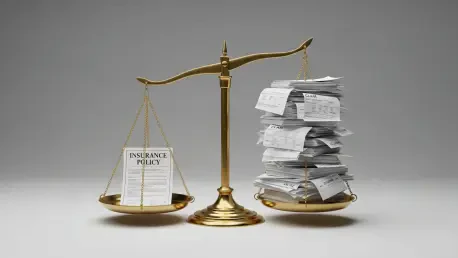

The world of philately, a hobby centered on the quiet study and collection of stamps, is rarely the backdrop for billion-dollar legal disputes. However, a lawsuit filed in the Eastern District of New York has thrust it into an intense spotlight, pitting insurer XL Specialty against Ideal Stamp Company in a case of truly staggering proportions. At the heart of the conflict is a fire claim for an alleged $3.35 billion, an amount the insurer argues is founded on material misrepresentation. This timeline will trace the key events, from the initial insurance application to the explosive court filing, to understand how a commercial policy for a stamp dealer escalated into one of the most remarkable insurance claims in recent memory. The case serves as a critical examination of disclosure, valuation, and the legal principle of utmost good faith in commercial insurance contracts.

From Policy Inception to Courtroom Showdown

November 2019 – The Policy Application and Declared Value

The story begins when Ideal Stamp Company and its affiliate, Inter Governmental Philatelic Corp., applied for a commercial dealer policy with XL Specialty Insurance Company. In their application, the dealers declared that the average and maximum monthly value of their inventory was $15 million. They further specified that the highest-priced item they had for sale was valued at $1,000, with the average item selling for just $10. This crucial disclosure formed the basis upon which XL Specialty agreed to underwrite the policy and calculate the premium.

October 2024 – A Devastating Warehouse Fire

Nearly five years after the policy was issued, a fire broke out at the warehouse where the stamp dealers stored their inventory. The event triggered the loss provision in the insurance policy, setting the stage for the insureds to file a claim for their damaged or destroyed property. This fire would become the catalyst for the subsequent dispute that would challenge the very foundation of their insurance agreement.

January 2025 – The Initial Claim Submission

Three months after the fire, Ideal Stamp Company submitted its first proof of loss. The claim listed 3.15 million damaged items with an asserted total value of $23.7 million. While this figure already exceeded the maximum $15 million inventory value declared in the 2019 application, it was only the first in a series of rapidly escalating valuations that would soon follow.

July 2025 – A Sharply Revised Valuation

Six months later, the stamp dealers submitted a revised claim that significantly raised the stakes. The new documentation more than doubled the previous figures, now asserting that 6.4 million items had been damaged in the fire. The corresponding value jumped to $55.2 million, deepening the discrepancy with the original policy application and raising significant questions for the insurer about the true scope of the loss.

September 2025 – The Astonishing $3.35 Billion Claim

The dispute reached its apex with the submission of a final, dramatically altered claim. In a spreadsheet, the insureds presented a new inventory list containing approximately 335 million damaged items. The total claimed selling price for this inventory was an astronomical $3.35 billion—more than 200 times the maximum value disclosed when the policy was first obtained. This unprecedented figure transformed the case from a standard claims investigation into a major legal confrontation.

January 2026 – XL Specialty Files Suit to Void the Policy

Responding to the multi-billion-dollar claim, XL Specialty Insurance Company filed a federal lawsuit seeking a declaratory judgment to void the policy from its inception. The insurer’s legal action, filed on January 30, 2026, alleges that the stamp dealers made material misrepresentations on their application, thereby invalidating the coverage. The insurer formally rescinded the policy and tendered the premium back to the defendants, signaling its intent to fight the claim vigorously.

Analyzing the Escalation and Its Implications

The most significant turning point in this timeline is the September 2025 claim, which escalated the valuation into the billions and triggered the insurer’s lawsuit. The overarching pattern is one of progressive and unexplained inflation in both the quantity of items and their total worth, moving from a plausible $23.7 million claim to a scarcely believable $3.35 billion figure. This trajectory highlights a fundamental breakdown in the claims process. A notable gap in the narrative remains the insureds’ official justification for this monumental discrepancy, an explanation that will undoubtedly become a central focus of the pending legal proceedings. The case underscores the critical importance of accurate valuation and consistent reporting in the insurance relationship.

The Legal Grounds and Lingering Questions

XL Specialty’s lawsuit rests on two primary legal arguments. The first is “material misrepresentation,” which posits that had the insurer known the true potential value of the inventory, it would never have issued the policy under the same terms, if at all. The second, an alternative argument, invokes a policy exclusion for fraudulent or dishonest acts. The insurer’s position is bolstered by financial records showing the stamp business operated at a loss for most years between 2019 and 2024 and testimony from an insured representative who reportedly could not explain the valuation leap. This case challenges the common misconception that insurers seek to avoid any large claim; rather, it demonstrates that legal challenges are often rooted in the integrity of the information provided by the insured long before a loss ever occurs.