From Simple Claim to Federal Case: The Dispute Unpacked

A seemingly minor clerical error involving a European date format has catapulted a Texas contractor and its insurer into a high-stakes federal lawsuit, illuminating the severe financial and legal consequences of a simple misreading. The case of JHG, LLC versus Mesa Underwriters Specialty Insurance Company (MUSIC) spiraled from a standard construction claim into a legal battle for treble damages, alleging bad faith practices. This dispute traces the critical events that led a straightforward coverage issue to a complex federal case, serving as a cautionary tale for both policyholders and insurance professionals about the importance of meticulous claims handling, clear communication, and the powerful legal doctrine of estoppel.

A Timeline of Escalation: How the Claim Unraveled

July 2022 – January 2023 – The Policy and the Project

The groundwork for the conflict was laid between July 15, 2022, and July 15, 2023, the effective dates of JHG’s commercial general liability policy with MUSIC. In January 2023, JHG commenced a construction project for its client, Fort Vale, Inc., placing the work squarely within the policy’s coverage window. However, a crucial detail within the construction contract would become the central point of contention: it utilized a European date format (day/month/year), a common practice internationally but one that proved to be a significant stumbling block.

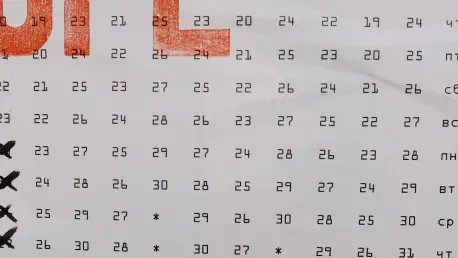

July 2024 – A Misinterpreted Date Sparks a Denial

The situation escalated in July 2024 when Fort Vale sued JHG over the construction work. Acting as expected, JHG promptly tendered the claim to MUSIC, seeking the legal defense its policy promised. The insurer, however, denied coverage. MUSIC allegedly misinterpreted the contract’s start date of “11/1/23” as November 1, 2023—a date falling four months after the policy’s expiration. JHG argues this was a clear error, as the correct date was January 11, 2023, a fact it claims was clarified by other supporting documents. To bolster its denial, MUSIC also asserted that the policy did not cover work that started during the policy period but was completed after, an exclusion that JHG contends does not exist in the policy’s text.

Late 2024 – Mid-2025 – The Contractor Fends for Itself

Following MUSIC’s denial, JHG was left to defend itself against the Fort Vale lawsuit. The contractor was forced to retain its own legal counsel, bearing the full financial weight of the litigation without the support it had paid premiums for. Over the subsequent months, JHG single-handedly managed its legal defense, accumulating approximately $100,000 in attorney’s fees and related costs while its insurer remained on the sidelines.

September – December 2025 – A Reversal Without Reservation

The dynamic shifted dramatically in September 2025. After JHG’s attorneys issued a formal demand letter citing the Texas Prompt Payment of Claims Act, MUSIC executed a complete reversal. The insurer withdrew its denial, appointed a law firm to take over JHG’s defense, and began to manage the claim. Critically, MUSIC took these actions without issuing a reservation of rights letter, a formal notice that would have allowed it to defend JHG while still preserving its right to challenge coverage obligations later. This sequence of events culminated in MUSIC funding a mediated settlement between JHG and Fort Vale in December 2025, which resolved the underlying construction dispute.

Post-December 2025 – The Final Standoff

Although the lawsuit with Fort Vale was settled, the conflict between JHG and MUSIC was far from over. The insurer failed to reimburse JHG for the $100,000 in legal expenses the contractor had incurred during the initial period of denial. This refusal became the final straw, prompting JHG to file its own federal lawsuit against MUSIC. The suit seeks not only the full $100,000 reimbursement but also statutory 18% interest and treble damages under the Texas Insurance Code, alleging that MUSIC engaged in knowing, unfair, and deceptive practices.

Key Missteps and Their Legal Consequences

The timeline of this dispute reveals two pivotal moments that transformed a coverage disagreement into a significant bad faith lawsuit. The first was the initial claim denial, which JHG argues was based on a failure of due diligence—an easily verifiable date format error. The second, and arguably more critical, misstep was MUSIC’s decision to assume the defense and fund the settlement without issuing a reservation of rights. This action forms the cornerstone of JHG’s argument that the insurer is now “estopped,” or legally barred, from retroactively disputing its duty to cover the claim. The case now centers on an insurer’s fundamental obligation to act in good faith, an obligation JHG alleges was repeatedly breached.

The Doctrine of Estoppel and Lessons for the Industry

The JHG lawsuit has thrown a spotlight on estoppel, a crucial but often overlooked doctrine in insurance law. By defending and settling a claim without reserving the right to contest coverage, an insurer can inadvertently waive its policy defenses. JHG’s argument is that MUSIC’s actions amounted to an admission of coverage, which made its subsequent refusal to pay the prior defense costs legally indefensible. The legal battle that ensued served as a stark reminder to claims professionals about the perils of misinterpreting documentation and the procedural necessity of issuing a timely reservation of rights. For policyholders, the case demonstrated the power of statutory tools like the Texas Prompt Payment of Claims Act in holding insurers accountable for their conduct and coverage decisions.