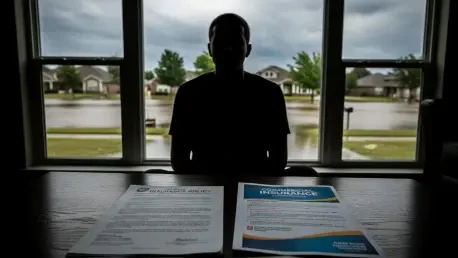

For countless homeowners residing in America’s coastal and flood-prone regions, the escalating cost of flood insurance has become a significant source of financial anxiety, threatening the affordability of their homes and the stability of their communities. This persistent challenge is exacerbated by a market structure that has long insulated the primary federal program from significant competition, leaving consumers with limited choices and little leverage against rising premiums. In response to this growing crisis, a bipartisan legislative effort has been renewed, aiming to dismantle a key regulatory barrier that has prevented the emergence of a more dynamic and competitive private insurance marketplace, offering a potential pathway to lower rates and greater consumer choice. This proposed reform targets a specific, yet powerful, rule that has inadvertently discouraged homeowners from seeking potentially more affordable coverage options outside the established federal system, locking them into a single provider out of fear of future financial penalties.

The Barrier to a Competitive Market

At the heart of the issue lies a provision within the Federal Emergency Management Agency’s (FEMA) National Flood Insurance Program (NFIP) known as the “continuous coverage” requirement. This rule was designed to reward long-term policyholders by allowing them to retain lower, “grandfathered” rates, even as official flood maps and risk assessments change over time. However, this benefit comes with a critical catch: the continuous coverage must be maintained exclusively with the NFIP. If a homeowner decides to switch to a private insurance plan, perhaps one that offers a better rate or more comprehensive coverage, and later finds a need to return to the NFIP, they are treated as a new applicant. Consequently, they forfeit their grandfathered status and are subjected to the current, and often substantially higher, full-risk rate. This policy creates a powerful disincentive for homeowners to explore the private market, effectively penalizing them for shopping around. The fear of losing a subsidized rate in the future traps consumers, stifles the growth of private insurance options, and prevents the natural price reductions that healthy competition typically provides in a free market.

A Legislative Solution for Homeowners

The proposed “Continuous Coverage for Flood Insurance Act” offers a direct and elegant solution to this long-standing market inefficiency. The legislation would amend the existing rules to require FEMA to recognize compliant, non-NFIP insurance policies as fulfilling the continuous coverage requirement. This single change would fundamentally alter the landscape for consumers, empowering them to shop for the best flood insurance policy between the NFIP and private insurers without the looming threat of a severe financial penalty should they need to switch back. According to the bill’s sponsors, Representatives Maria Elvira Salazar and Kathy Castor, this reform is crucial for injecting healthy competition into the market, which is the most effective mechanism for lowering premiums. By leveling the playing field, the act would not only expand consumer choice and promote financial stability for families but also serve the broader public interest. A more robust private market would assume a greater share of the flood risk, reducing the immense financial burden currently placed on the NFIP and, by extension, on all U.S. taxpayers, creating a more sustainable model for managing flood risk nationwide.