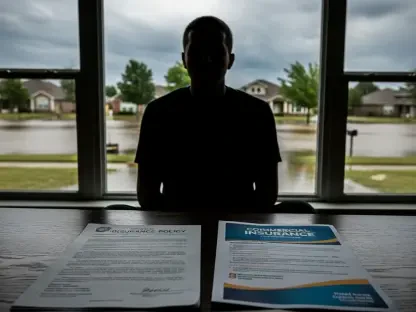

Hurricane Milton’s impending arrival has sent shockwaves through Florida’s already fragile property insurance market. Just weeks after Hurricane Helene left a trail of devastation, the state now braces for another potentially catastrophic event. Milton, forecasted to strike near the Tampa Bay area as a Category 4 storm, is poised to challenge the resilience of insurers, policyholders, and the overall financial stability of the region’s insurance industry.

A Double-Edged Sword: Wind and Flood Damage

The Severity of Hurricane Milton

Hurricane Milton is not your average storm; its impact is expected to be extraordinary. Packing maximum sustained winds of 145 mph, it threatens massive wind damage and substantial flooding. Forecasts suggest it will hit near the densely populated Tampa Bay area, making the potential for widespread damage exceedingly high. This combination of wind and water damage is particularly alarming for a state still recovering from Hurricane Helene’s recent flooding.

The combination of high winds and potential for flooding presents a daunting challenge. With the state’s infrastructure already weakened by Hurricane Helene, Milton’s arrival could lead to catastrophic structural failures and incapacitated utilities, aggravating the existing crisis. As winds approach top speeds, the probability of destructive storm surges and inland flooding rises, endangering lives and escalating property damage forecasts to unprecedented levels. Insurance companies, already under stress from Helene’s aftermath, now face a stark reality: a seemingly insurmountable pile of claims that could strain their financial resources to the breaking point.

Compounding Effects of Previous Storms

While Hurricane Helene caused extensive flooding, generally not covered by standard property insurance policies, it left a hazardous landscape strewn with debris. This debris can become dangerous projectiles in the high winds expected from Milton, further aggravating the damage. The timing of these back-to-back hurricanes leaves little room for recovery, putting immense pressure on both the insurance market and homeowners.

The consequences of these consecutive storms reach beyond cleanup and rebuilding; they put the insurance market in a precarious position. The debris from Helene acts as fuel for destruction, heightening the likelihood of more severe damage during Milton. This creates a vicious cycle where the severity of each subsequent storm exacerbates the vulnerabilities exposed by its predecessors. Homeowners, already exasperated by the slow recovery from Helene, now face the double blow of Milton’s imminent impact, further complicating an already distressing scenario. The strained recovery resources and overwhelmed insurance mechanisms reflect a market pushed to its limits, hanging by a thread as it contends with relentless natural forces.

Financial Strain on Insurers

Reinsurance Under Pressure

The aftermath of Hurricane Milton is expected to place a significant burden on the reinsurance sector, which provides backup coverage for primary insurers. Given the high volume of anticipated claims, reinsurers may increase their prices and impose stricter terms. This could result in higher reinsurance costs for Florida’s insurers, who are already heavily dependent on this secondary market to stay afloat. The heightened demand for reinsurance post-Milton might reshuffle the market dynamics, driving up costs and making it more difficult for insurance companies to secure adequate coverage.

Reinsurers, facing a deluge of claims, will likely re-evaluate their risk models and pricing strategies, which could lead to a tightening of the market. Already under pressure from Helene, reinsurers will be cautious, possibly opting for more conservative terms and elevating premiums. Insurers dependent on this backup coverage would subsequently face increased operational costs, translating into higher premiums for policyholders. This financial domino effect could ripple through the market, impacting not just the insurers but also the broader economic stability of Florida, as insurance becomes both more expensive and harder to obtain.

Vulnerabilities of Florida Specialists

Florida’s insurance market is characterized by the presence of “Florida specialists” — companies that predominantly operate within the state. These firms rely extensively on reinsurance to mitigate their risks. With a surge in claims expected from Hurricane Milton, many of these insurers may face severe strain on their capital reserves, potentially leading to insolvencies. The financial fragility of these companies could ripple through the market, affecting policyholders and overall market stability. The concentrated risk among these specialists makes them particularly vulnerable to natural disasters, which could, in turn, lead to reduced competition and fewer choices for consumers.

As capital reserves dwindle, the likelihood of insolvencies increases, putting the entire market at risk of destabilization. Policyholders may find their coverage jeopardized if their insurers go under, leading to a potential increase in the uninsured population. The impact on consumer trust could be significant, as confidence wanes in the ability of insurers to meet their obligations. In this precarious environment, the focus may also shift towards regulatory measures and state-backed solutions to maintain market sustainability and protect policyholders amidst an escalating cycle of natural disasters.

Market Dynamics and Consumer Implications

Escalating Premiums and Policy Availability

The dual impact of Hurricanes Helene and Milton could disrupt the market’s supply-demand balance. Reduced availability of property insurance and increased premiums could become the norm, as insurers grapple with financial losses. Consumers could find it increasingly difficult to secure affordable coverage, exacerbating the market’s accessibility issues. The financial strain on insurance companies will likely lead to a reevaluation of their policy portfolios and risk strategies, prioritizing their survival over consumer affordability.

As insurers hike premiums to cover their escalating costs, the market could see a contraction in policy availability, particularly for high-risk properties. This shift will hit homeowners the hardest, especially those in disaster-prone areas, who may find themselves priced out of the market or unable to secure any coverage at all. Such a scenario leaves a significant portion of the population vulnerable to future disasters, creating a cycle of financial instability and heightened risk. The broader economic implications could see a downturn in the housing market as property values decline in the absence of viable insurance options.

Role of Citizens Property Insurance Corp.

As the insurer of last resort, Citizens Property Insurance Corp. has seen its policy counts fluctuating with the market’s health. Although efforts have been made to reduce its policy numbers, the potential claims surge from Hurricane Milton could counteract these efforts, leading to a rise in policy counts. This would further strain Citizens’ resources and operational capacity, impacting its long-term viability and the state’s insurance landscape. The organization’s role is becoming increasingly pivotal as private insurers withdraw from high-risk areas or impose prohibitive premiums.

Given the dual impact of recent hurricanes, Citizens may have to reassess its strategies and preparedness to handle a surging number of policyholders. The strain could lead to operational challenges, affecting the speed and efficiency of claims processing and customer service. The financial sustainability of Citizens would come under scrutiny, potentially prompting discussions around state or federal support to ensure its continued functionality. This increased reliance on the insurer of last resort may also push policymakers to explore more sustainable, long-term solutions for managing insurance in disaster-prone regions.

The State of Florida’s Insurance Market: A Year in Review

Signs of a Rebound

Prior to these catastrophic events, Florida’s insurance market had shown signs of recovery. The insurance sector had been stabilizing, albeit slowly, after years of financial hardship that forced many insurers to drop policies and hike rates. These challenges had contributed significantly to making Citizens Property Insurance Corp. the largest insurer in the state. The market was beginning to see a potential turnaround, with insurers starting to regain their footing and adjust to new regulatory and financial realities.

Growth in the market was evidenced by gradual reductions in Citizens’ policy numbers and slight moderations in premium hikes. Efforts to attract new insurers and reintroduce competition were starting to take root. Some firms were cautiously expanding their coverage areas, and innovations in risk management and underwriting practices were creating efficiencies. However, this fragile recovery now faces the colossal challenge posed by back-to-back hurricanes, threatening to undo the progress and thrust the market back into turmoil.

Existing Vulnerabilities

Despite these positive trends, the market remains inherently vulnerable. The heavy reliance on reinsurance, the concentration of risk among Florida specialists, and the persistent threat of natural disasters are critical issues that need to be addressed. Hurricane Milton could expose these vulnerabilities more starkly, highlighting the need for strategic reforms and robust financial safeguards. The insurance market’s structural weaknesses call for systemic changes to ensure long-term stability and resilience against future catastrophes.

The aftermath of Milton will likely bring these vulnerabilities to the forefront, sparking debates on policy reforms and industry regulations. The market’s dependence on reinsurance and specialist firms underscores a critical need for diversification and risk distribution. Additionally, strategies to mitigate the impact of natural disasters, including improved building codes, flood defenses, and community preparedness programs, must be prioritized. Addressing these systemic flaws will be crucial for fostering a more robust and adaptive insurance market capable of withstanding Florida’s unique environmental challenges.

Government and Policy Responses

State-Level Interventions

Florida’s government has a crucial role to play in mitigating the impending crisis. Policy interventions aimed at stabilizing the insurance market, providing financial aid to insurers, and protecting consumers are urgently needed. These measures could include offering state-backed reinsurance support, incentivizing disaster resilience among homeowners, and streamlining claims processes to ensure rapid recovery. Proactive engagement by state officials will be essential in preventing a market collapse and ensuring that consumers have access to reliable insurance coverage.

Strategic initiatives might also encompass regulatory changes to enhance market transparency and fairness, fostering a more competitive environment. This could involve revisiting rate-setting mechanisms, encouraging the entry of new players, and enforcing strict compliance to prevent market manipulations. The state’s ability to swiftly implement these policies could make a significant difference in cushioning the market against immediate and future shocks. A coordinated effort that balances insurer viability with consumer protection will be pivotal in navigating the market through this turbulent period.

Potential for Federal Assistance

The looming threat of Hurricane Milton has thrown Florida’s already delicate property insurance market into a state of turmoil. This comes just weeks after Hurricane Helene caused widespread destruction, leaving the state’s residents and insurers with little time to recover. Now, with Milton predicted to make landfall near the Tampa Bay area as a powerful Category 4 storm, the situation has become even more dire. The intensity of Milton is set to test not only the resilience of the insurers who provide coverage but also the peace of mind of policyholders, who are anxiously preparing for the worst. Beyond the immediate fear of property damage and personal loss, there is growing concern about the long-term financial stability of the region’s insurance industry. This consecutive barrage of severe storms raises questions about how insurance companies will cope with the increasing frequency and severity of these natural disasters. Florida, a state already grappling with high premiums and a volatile market, faces an uncertain future as it braces for another potentially devastating hurricane.