The global Valuables Insurance market, encompassing both business and personal insurance sectors, has demonstrated considerable growth over recent years, reflecting a broader trend toward safeguarding high-value assets. As the market continues to evolve, it is segmented by application into categories such as artworks, jewelry, and other valuable items, which helps to identify niche markets and potential opportunities for expansion and investment.

Market Overview

A comprehensive analysis of the Valuables Insurance market reveals its substantial state of growth, driven by technological advancements and shifts in consumer behavior. The market size has seen a significant uptick recently, with future expansion projected as more individuals and businesses seek to insure their valuable assets. These trends indicate a healthy trajectory for the industry, encouraging stakeholders to keep a close eye on developments.

Segmentation Analysis

The segmentation of the Valuables Insurance market is crucial for understanding its dynamics. Dividing the market based on product type, application, end-user, and region allows for a more focused evaluation of segment performance. The primary segments—artworks and jewelry—are particularly notable for their growth potential. This segmentation also provides a clearer view of niche markets that may offer unique opportunities for investment.

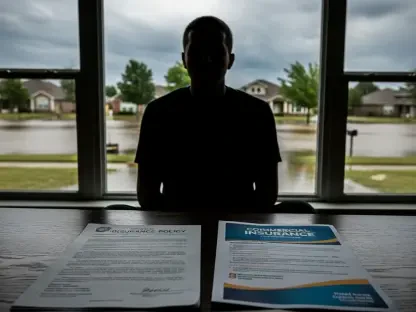

Key Drivers and Barriers

Several factors drive the market forward, including continual technological advancements that make insurance policies more accessible and comprehensive. Consumer behavior is also shifting towards increased protection of high-value assets due to rising awareness of potential risks. However, the market faces barriers such as economic constraints and complex regulatory environments that may hinder its growth. Understanding these obstacles is essential for devising effective strategies to navigate them.

Competitive Landscape

The Valuables Insurance market is highly competitive, with numerous key players vying for market share. Detailed profiles of these market leaders reveal their strategies, competitive positions, and share of the market. This competitive landscape analysis is integral for new entrants and established companies alike, providing insights into successful market strategies and areas where they can gain a competitive edge.

Geographical Analysis

Regional disparities play a significant role in shaping the Valuables Insurance market. Different regions present unique challenges and opportunities, affecting market dynamics. For instance, certain regions may offer substantial growth opportunities due to higher concentrations of high-value assets, while others might present regulatory challenges that need to be managed carefully. This geographical analysis is pivotal for companies looking to expand their market presence strategically.

Industry Predictions

Looking ahead, forecasts for the Valuables Insurance market over the next five to ten years are optimistic, taking into account various economic conditions, market trends, and technological advancements. Businesses should prepare for continued growth and be ready to adapt to changing market conditions. Strategic planning based on these forecasts can help companies maintain a competitive edge and capitalize on emerging opportunities.

Impact of COVID-19

The COVID-19 pandemic has had a profound influence on the Valuables Insurance market, initially causing disruptions but also creating new opportunities. Changes in supply chain dynamics and fluctuations in demand have reshaped the market landscape. However, the pandemic has also heightened awareness about risk management, encouraging more individuals and businesses to insure their valuable assets, thus presenting new growth avenues.

Strategic Advice

For businesses looking to enter or strengthen their position in the Valuables Insurance market, strategic recommendations include forming alliances, adopting effective market entry approaches, and diversifying their offerings. Identifying and exploring differentiation strategies can set companies apart in this competitive market. Tailoring strategies to meet regional demands and understanding the unique challenges of each segment can also lead to greater market penetration and success.

Strategic Insights

The global Valuables Insurance market, covering both corporate and personal sectors, has seen significant growth in recent years. This trend reflects an increased emphasis on protecting high-value assets. As this market evolves, it’s essential to note its segmentation by application. Categories such as artworks, jewelry, and other valuable items play a pivotal role in identifying niche markets. This segmentation provides key insights into potential opportunities for expansion and investment.

Insurance for valuable items has become increasingly important as people recognize the need to secure their high-value possessions. High-net-worth individuals and collectors are particularly concerned about the safety of their assets. The emergence of specialized policies tailored to these categories demonstrates the industry’s response to these concerns.

By understanding the specific needs of different segments, insurers can develop more targeted and effective products. This targeted approach not only aids in risk management but also offers a competitive edge in the market. As a result, both businesses and individuals can benefit from tailored insurance solutions that offer comprehensive protection for their most prized possessions.