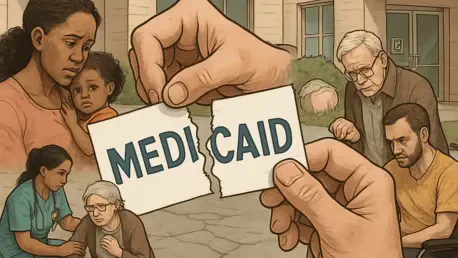

The implications of President Donald Trump’s recent tax legislation, known as the “One Big Beautiful Bill,” extend far beyond its financial ramifications. A central point of concern is its potential to leave millions without health coverage, notably affecting Medicaid, the vital public health insurance program for low-income Americans. One significant issue surrounding Medicaid involves its complex structure—programs are state-specific and often operate under different names, leading to confusion among beneficiaries about their enrollment status. Across the United States, initiatives like Medi-Cal in California, Hoosier Healthwise in Indiana, and BadgerCare Plus in Wisconsin have intentionally veiled their affiliation with federal Medicaid in a bid to distance from welfare stigma. However, this branding shift has inadvertently contributed to misunderstanding and a gap in awareness, leading many to overlook the fact that their health insurance is Medicaid-funded.

Impact of Federal Budget Cuts

The tax law on the table outlines a formidable $1 trillion cut to Medicaid funding across the next decade, prompting deep concerns regarding the breadth of coverage retention. Within California, Governor Gavin Newsom has underscored the potential fallout from these reductions, pointing out that almost 3 million Californians could find themselves uninsured by 2027 if the cuts proceed as planned. California’s Medi-Cal program, which currently serves roughly 14.7 million residents, faces significant pressure from these projected financial constraints. The legislation includes an array of requirements for beneficiaries between the ages of 19 and 64. This group is required twice yearly to demonstrate that they engage in 80 hours of labor, education, or community involvement monthly. Failure to comply with these stipulations could lead to the termination of their Medicaid coverage, presenting a formidable challenge to many who rely entirely on this public insurance scheme for healthcare access.

The proposed cuts represent a significant departure from current Medicaid funding structures, fundamentally transforming how services are delivered and who ultimately bears the financial burden. As of 2023, the federal government shouldered 69% of Medicaid expenses, leaving the remaining 31% to state governments. However, unsustainable cuts suggest a looming shift, with states expected to assume greater responsibility for funding healthcare services amidst shrinking federal support. Past examinations reveal substantial friction faced by other states when federally backed resources for Medicaid diminish. For those dependent on these programs, safeguarding coverage continuity has become an existential concern, as state budgets struggle to meet the shortfall and sustain accessible health services.

Role of Managed Care Organizations

Managed care organizations (MCOs) play a significant role in Medicaid administration, adding further complexity to the issue. Approximately 75% of Medicaid recipients are enrolled in managed care plans, where states contract private companies like Centene and UnitedHealth Group to provide managed services instead of handling the administrative burden directly. This arrangement has contributed to confusion among beneficiaries regarding their coverage source. Interacting more readily with these private insurers, many beneficiaries mistakenly identify their health insurance as private rather than Medicaid-funded. Such misunderstanding can lead to significant surprises for beneficiaries if they suddenly find themselves without coverage.

Without a natural awareness of their Medicaid connections, many beneficiaries remain oblivious to the incoming changes in policy and regulation. Experts like Pamela Herd, a social policy professor, emphasize that this lack of understanding can have dire consequences. Herd notes that beneficiaries who are unaware of new work obligations may unwittingly lose their coverage. Dr. Benjamin Sommers, a professor of health care economics, echoes this sentiment by highlighting the potential for those losing Medicaid to remain uninsured due to the scarcity of affordable alternative options. Historic situations, such as the experience in Arkansas where similar work requirements led to increased uninsured rates without corresponding rises in employment, demonstrate the potential pitfalls facing affected populations.

Medicaid Enrollment Confusion

The confusion stemming from Medicaid enrollment statistics adds another layer of complexity to the discussion. Official records showed 78.5 million Americans were on Medicaid by the end of 2023, yet reported figures from respondents totaled only 62.7 million. This notable discrepancy suggests a widespread lack of awareness among recipients regarding the foundation of their coverage. This factor becomes increasingly concerning as the policy changes approach, risking many people’s coverage if they fail to promptly meet the compliance requirements outlined by federal regulations. Understanding these discrepancies, known as the “Medicaid Undercount,” and addressing the factors driving them could hold the key to mitigating coverage gaps.

The mixed messaging inherent in Medicaid’s varying state brands further complicates recipients’ understanding of their health insurance source. Similarly, the looming budget cuts demand prompt action from policymakers and state governments to address these discrepancies. With an unvarnished view of the challenges at hand, stakeholders must prioritize outreach and education efforts, arming beneficiaries with knowledge about the origins and updates to their coverage. Proactive information campaigns that break down financial impacts into tangible terms ensure that Medicaid recipients are equipped with essential tools to preserve access to their necessary healthcare services amidst rapid changes.

Challenges of the Work Requirements

Adding to the myriad of challenges posed by the tax legislation is the introduction of work requirements for those benefiting from Medicaid. Under these stipulations, beneficiaries between the ages of 19 and 64 must verify twice a year that they participate in a minimum of 80 hours of work or in educational or community service activities monthly. Should beneficiaries fail to meet these requirements, they risk losing their health coverage, which can present significant challenges for vulnerable communities. The effort to enforce these work requirements involves unprecedented paperwork and administrative burden both for beneficiaries and the states, creating further obstacles in maintaining necessary health coverage.

Critics argue that such requirements could disproportionately affect low-income individuals and families who rely heavily on Medicaid for essential healthcare coverage. Many of those presently covered by Medicaid face employment barriers, such as lack of access to transportation, ill health, or caregiving responsibilities, which make fulfilling work requirements exceedingly difficult. Furthermore, states face logistical challenges in tracking and verifying compliance, which could result in unintended enrollment interruptions or coverage denials. If managed improperly, these convoluted processes underscore the urgent need for equitable policy frameworks that leave room for nuance.

Policy Reform and Future Considerations

The proposed tax legislation proposes a significant reduction in Medicaid funding, amounting to a staggering $1 trillion cut over the next ten years. This has raised serious concerns about maintaining comprehensive healthcare coverage. California Governor Gavin Newsom has highlighted the potential adverse effects of these cuts, noting almost 3 million Californians could lose insurance by 2027 if these cuts proceed. California’s Medi-Cal program, which currently covers approximately 14.7 million residents, is expected to face substantial challenges due to these budget constraints. The law imposes new requirements for beneficiaries aged 19 to 64, necessitating them to verify twice a year that they complete 80 hours of work, education, or community service monthly. Noncompliance may lead to losing Medicaid benefits, posing a significant obstacle for those who depend on public insurance for healthcare. This shift departs significantly from the current Medicaid funding structure, placing more financial burden on states as federal support dwindles, mirroring past difficulties experienced by states in similar situations.