Imagine a world where the cost of protecting your car and home steadily decreases, easing the financial burden on households across the UK, and in recent months, this scenario has become a reality with motor and home insurance premiums showing a consistent downward trend. This roundup dives into the latest pricing shifts in the UK insurance market, gathering opinions, tips, and analyses from various industry sources and experts. The purpose is to provide a comprehensive view of why these declines are happening, how they impact consumers and insurers, and what might lie ahead in this evolving landscape.

Unpacking the Trend: Why Are Insurance Costs Dropping?

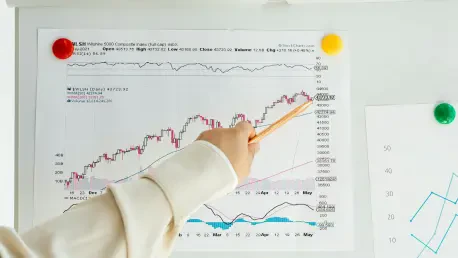

The decline in UK insurance premiums has caught the attention of many, with motor and home coverage costs falling noticeably over recent months. Data indicates a gradual softening in motor insurance, with a month-on-month drop of 0.9%, while home insurance has seen a sharper reduction of 2.0% in the same period. This shift prompts questions about the driving forces behind such changes and how they reflect broader market dynamics.

Industry observers point to a mix of competitive pressures and stabilizing claims environments as key contributors. Some suggest that insurers are recalibrating their pricing models to attract new customers in a crowded market, while others highlight a reduction in large-scale claims as a factor easing premium costs. These varying perspectives set the stage for a deeper exploration of the data and opinions surrounding this trend.

A critical aspect of this discussion is understanding the implications for everyday consumers. With median motor premiums now at £434 and home premiums dipping to £196, households may find room in their budgets for other expenses. However, there remains debate over whether these reductions signal a long-term shift or a temporary adjustment, a theme that will be unpacked through diverse viewpoints.

Motor Insurance: A Gradual Easing of Prices

Data and Trends: Slow but Steady Declines

Motor insurance premiums have shown a cautious but consistent decline, with a year-on-year reduction of 16.1% bringing costs down significantly. This slow softening reflects a market that appears to be moving toward stabilization after periods of volatility. The median premium of £434 marks a slight dip from the previous month, suggesting insurers are treading carefully in their pricing strategies.

Analysts from multiple industry reports note that this trend could be tied to improved risk assessment tools and a leveling off of claims frequency. Yet, there is caution in the air—rising repair costs and parts shortages remain potential hurdles. These factors create a complex backdrop where price drops might not persist if external pressures intensify.

Differing opinions emerge on the sustainability of this trend. Some market watchers argue that the current softening is a temporary response to competitive dynamics, while others believe technological advancements in underwriting could support ongoing reductions. This divergence in thought highlights the uncertainty still present in the motor insurance space.

Expert Takes: Balancing Optimism and Caution

Insights gathered from industry forums reveal a split in optimism about motor insurance pricing. Certain analysts emphasize the positive impact of data-driven decision-making, which allows insurers to fine-tune premiums with greater accuracy. They see this as a potential driver for continued price moderation over the next few years.

On the flip side, a segment of industry professionals warns of looming challenges like claims severity, which could offset recent gains. Repair costs, influenced by inflation and supply chain disruptions, are flagged as a significant concern that might push premiums upward if not addressed. This perspective urges a balanced view of the current market relief.

A third angle comes from those focusing on consumer behavior, noting that demand for comprehensive coverage could influence future pricing. If drivers opt for more robust policies amid economic uncertainty, insurers might adjust rates to cover heightened risks. These contrasting views paint a nuanced picture of the motor insurance landscape.

Home Insurance: A More Pronounced Price Reset

Sharp Declines: Numbers Tell the Story

Home insurance premiums have experienced a more dramatic adjustment, with a year-on-year decrease of 11.7% and a monthly drop of 2.0%. The median premium now sits at £196, a notable low not seen in over a year. This sharper reset indicates a market undergoing significant recalibration, influenced by various competitive and risk factors.

Industry data points to consecutive monthly declines as evidence of insurers responding to reduced claims pressures in certain property segments. This trend is seen as a relief for homeowners grappling with rising living costs elsewhere. However, the pace of these reductions raises questions about how long such competitive pricing can be maintained.

Some sources caution that seasonal risks, particularly winter weather events, could disrupt this downward trajectory. Floods, storms, and other damages often spike during colder months, potentially prompting insurers to revisit their pricing models. This adds a layer of complexity to interpreting the current home insurance environment.

Industry Voices: Competition vs. Risk Management

A collection of industry insights reveals that heightened competition is a primary driver of falling home insurance premiums. Several market analysts note that insurers are aggressively lowering rates to capture market share, especially in densely populated or high-demand regions. This race to offer the lowest premiums is reshaping customer expectations.

Conversely, a different group of observers stresses the importance of aligning pricing with actual loss costs. They argue that while competition drives short-term reductions, insurers must prepare for unexpected spikes in claims, particularly from environmental hazards. This viewpoint advocates for a more cautious approach to pricing adjustments.

An additional perspective focuses on segmentation as a future strategy. Some industry thought leaders suggest that insurers may soon tailor premiums more closely to property types and regional risks, moving away from broad price cuts. This potential shift could redefine how home insurance costs are calculated, balancing affordability with risk exposure.

Regional Variations: Uneven Declines Across the UK

Localized Trends: Where Costs Are Dropping Most

Geographic disparities in premium declines add another dimension to the UK insurance story. Motor insurance costs have fallen most notably in regions like the North East and West Midlands, each recording a 1.3% monthly reduction. For home insurance, the West Midlands leads with a 2.5% drop, closely followed by Yorkshire & the Humber at 2.4%.

These regional differences are attributed to varying claims patterns and local market competition. Areas with historically lower claim frequencies or less severe incidents tend to see faster premium reductions. Insurers appear to be adjusting their strategies based on these localized factors, creating a patchwork of pricing trends across the nation.

Questions arise about whether these disparities will widen or narrow over time. Some industry analyses suggest that regions with aggressive insurer competition might continue to see steeper declines, while others could stabilize if claims costs rise. This uneven landscape challenges the notion of a uniform national trend in insurance pricing.

Perspectives on Regional Impacts

Diverse opinions surface regarding the implications of these regional variations. One school of thought holds that localized pricing reflects a maturing market where insurers are becoming more granular in their risk assessments. This could benefit consumers in lower-risk areas with even more tailored pricing options.

Another viewpoint warns that such disparities might lead to perceptions of unfairness among policyholders in regions with slower declines. If premiums remain higher in certain areas despite national trends, customer dissatisfaction could push insurers to rethink their geographic strategies. This concern underscores the need for transparency in pricing decisions.

A further angle considers the role of local economic conditions in shaping these trends. Analysts note that regions with stronger economic growth might see more insurer investment and competition, driving premiums down faster. This intersection of economics and insurance pricing offers a fresh lens through which to view regional differences.

Insurer Strategies: Adapting to a Shifting Market

Tactical Responses: Pricing and Underwriting Shifts

Major UK insurers are navigating the declining premium environment with a range of strategies. Some are focusing on pricing discipline, ensuring that reductions do not compromise profitability. Others are tightening underwriting controls, particularly in motor insurance, to manage risk exposure more effectively.

A comparison of approaches reveals distinct priorities among industry players. While certain firms emphasize selective risk management to avoid high-claim profiles, others leverage advanced data analytics to refine pricing accuracy. These differing tactics highlight the challenge of balancing competitiveness with financial stability in a softening market.

Speculation abounds on how these strategies might influence market share. Companies that strike the right balance could gain a loyal customer base, while those overly focused on cutting premiums might face margin pressures. This strategic chess game is reshaping the competitive dynamics of the UK insurance sector.

Industry Opinions: Long-Term Implications

Gathered insights from market commentaries suggest that data-driven pricing will play a pivotal role in the future. Many believe that insurers adopting sophisticated analytics will maintain an edge, allowing them to offer competitive rates without sacrificing profitability. This view points to technology as a game-changer in the industry.

Contrasting opinions caution against over-reliance on technology, arguing that human judgment remains essential in assessing complex risks. Some industry voices stress that claims inflation, driven by external economic factors, could undermine even the most advanced pricing models if not monitored closely. This perspective calls for a hybrid approach to strategy.

A third stream of thought focuses on customer-centric adaptations, with suggestions that insurers should prioritize transparency and communication during this period of change. Building trust through clear explanations of pricing decisions could differentiate firms in a crowded market. This emphasis on customer experience adds depth to the discussion of insurer strategies.

Key Takeaways: What This Means for Stakeholders

Synthesizing the range of opinions, it’s evident that the decline in motor and home insurance premiums represents both opportunity and challenge. Motor insurance shows signs of gradual stabilization, while home insurance undergoes a deeper recalibration, with median costs reflecting significant relief for consumers. These dual trends underscore the varied pace of change across insurance segments.

For consumers, timing purchases during periods of competitive pricing could yield savings, but staying informed about regional trends is equally important. Insurers, on the other hand, are advised to leverage data analytics to remain agile, ensuring pricing reflects actual risks rather than just market pressures. These practical tips aim to guide both parties through the current environment.

Another key insight is the role of external factors like claims costs and seasonal risks in shaping future premiums. Stakeholders are encouraged to monitor these elements closely, as they could disrupt the current downward trajectory. This actionable advice seeks to equip consumers and insurers with the tools to navigate an evolving market landscape.

Final Reflections and Next Steps

Looking back, this roundup captured a pivotal moment in the UK insurance market, where motor and home premiums experienced notable declines, driven by competition and risk recalibration. Diverse perspectives from industry analyses painted a complex picture of stabilization in motor coverage and sharper resets in home policies, while regional variations and insurer strategies added layers of nuance to the discussion.

Moving forward, consumers are encouraged to stay proactive by comparing offers across regions and timing renewals strategically to capitalize on competitive rates. Insurers, meanwhile, face the task of refining data-driven models to balance affordability with profitability, especially as claims inflation looms as a persistent concern. A deeper dive into localized market reports and industry updates is recommended as a valuable step for staying ahead of emerging trends and challenges.