A comprehensive analysis of property owners reveals a critical and widening gap between the general awareness of escalating flood risks and any personal assessment of vulnerability, resulting in a significant lack of protective action. A recent study surveying over 1,500 high-net-worth property owners, commercial businesses, and insurance agents highlights a profound disconnect fueled by psychological biases, outdated information, and pervasive misconceptions about insurance coverage. The overarching theme of the findings is that while most acknowledge the reality of more frequent and intense flooding, this intellectual understanding has not translated into the adoption of necessary safeguards, most notably the purchase of adequate flood insurance. This discrepancy points to a dangerous complacency that leaves a growing number of properties exposed to potentially catastrophic financial losses as weather patterns continue to shift.

The Psychology of Complacency

The central finding of the survey is the paradoxical behavior of property owners who recognize the growing threat of flooding on a broad scale but fail to perceive it as a direct, personal risk. A vast majority of respondents, including 84% of high-net-worth homeowners, concur that flooding has become more common and intense. Despite this near-universal acknowledgment, a substantial portion of this group remains unprotected. Among those who have not purchased flood insurance, a striking 62% cited a perceived “low risk of flooding” to their own property as the primary reason for forgoing coverage. This demonstrates a fundamental cognitive dissonance where a general, abstract risk is not internalized as a concrete, individual threat. This behavior suggests that while public information campaigns have succeeded in raising general awareness, they have failed to penetrate the personal decision-making process of many property owners, leaving them vulnerable by choice.

This gap is further exemplified by data on geographic proximity to water. The survey revealed that 82% of high-net-worth homeowners reside within a three-mile radius of an ocean, lake, or river, placing them in objectively high-risk zones. Yet, their level of concern does not align with this elevated exposure; only 48% of these homeowners reported being seriously concerned about flooding. Commercial businesses displayed an even greater degree of complacency, with less than a quarter expressing extreme worry. This behavior is attributed to powerful psychological factors, including a “normalcy bias,” where individuals assume that because a flood has not happened to them in the past, it will not happen in the future. This is compounded by an “optimism bias,” the belief that while the risk is real, it will ultimately affect someone else. Together, these biases create a dangerous false sense of security that delays necessary action.

Flawed Perceptions and Persistent Myths

The survey identifies the sources of information property owners rely on as a key driver of this flawed risk perception. A majority turn to official, government-issued flood maps to assess their risk, with 70% of homeowners and 52% of businesses citing them as a primary resource. However, many of these maps are outdated and fail to capture the modern reality of flooding. They do not adequately account for the dramatic increase in extreme rainfall events and other forms of inland flooding not necessarily linked to a large body of water. Supporting this, U.S. government statistics show that 99% of all U.S. counties have been impacted by a flooding event since 1996, and nine of the ten years with the most severe one-day precipitation events have occurred since 1995. This indicates that flood risk is far more widespread and dynamic than historical maps suggest, making reliance on them a flawed and dangerous strategy for assessing true vulnerability in the current climate.

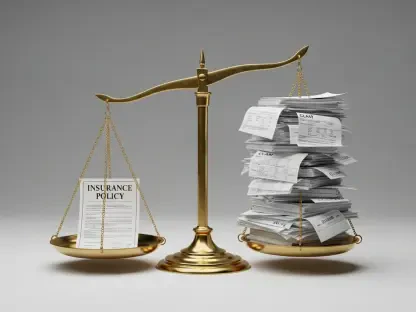

Beyond a misunderstanding of physical risk, the survey uncovered significant and persistent misconceptions about insurance coverage. A critical knowledge gap exists among the uninsured, with more than one in ten high-net-worth homeowners mistakenly believing their standard property policies automatically cover damage from natural floods. This false assumption is a major barrier to securing proper protection. For commercial businesses, the barriers are compounded by financial concerns, with 36% citing high premiums as a primary reason for not purchasing flood insurance. Even among those who have purchased coverage, a dangerous overconfidence prevails. Over 90% of insured businesses believed their coverage was adequate. However, of those that had experienced a recent flood, only 43% found their insurance fully covered the damages, leaving them with significant out-of-pocket expenses for repairs that often exceeded $50,000.

A Path Toward Greater Resilience

The investigation into the adoption of physical resilience and mitigation strategies found a similar pattern of awareness failing to spur action, particularly among homeowners. While nearly half of homeowners expressed confidence in the effectiveness of protective measures like enhanced drainage systems, flood barriers, and water sensors, fewer than a third had actually implemented any of them. In contrast, commercial businesses demonstrated a greater sense of urgency, with 58% actively seeking and implementing resilience tools and services. This disparity suggested that the dual threat of property damage and operational disruption motivated businesses to act more decisively. The clear lag in residential adoption of these proven protective measures highlighted a significant opportunity for improvement through better education and targeted incentives for homeowners to invest in their property’s long-term safety.

Ultimately, the analysis concluded that insurance agents and brokers were uniquely positioned to play a pivotal role in bridging these critical gaps in perception, knowledge, and action. Their expertise proved highly influential; among homeowners who did take steps to implement flood prevention measures, 52% cited the advice of a trusted expert as a key factor in their decision. This underscored the profound opportunity for industry professionals to proactively educate clients on their true risk profile, which often extends beyond outdated flood maps. By demystifying insurance coverages and clearly articulating the financial consequences of being underinsured, these advisors had the power to transform abstract awareness into concrete, protective measures, guiding their clients toward a more secure and resilient future in the face of increasing climate-related threats.