A retirement dream meticulously built on the promise of a secure, tax-free future allegedly unraveled into a multimillion-dollar nightmare for one of NASCAR’s most celebrated drivers, thrusting a controversial financial product into the glaring national spotlight. For two-time champion Kyle Busch

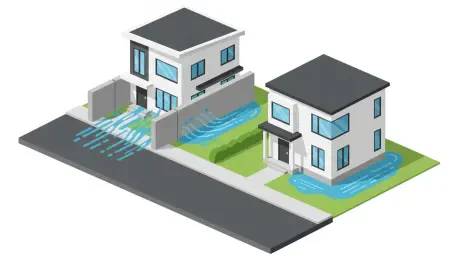

A significant and growing risk is jeopardizing the financial stability of Canadian homeowners and the insurance industry, not from a new and unforeseen threat, but from the absence of a critical tool: modern, accurate flood maps. As climate change continues to drive an increase in the frequency and

The maritime industry is currently charting a course through an increasingly complex and bifurcated insurance landscape, where economic crosscurrents, climate volatility, and rapid technological evolution create both significant opportunities and formidable challenges. This environment is defined

In a financial landscape where traditional fixed-income investments struggle to meet the long-term obligations of insurance carriers, a landmark partnership has emerged, signaling a definitive shift in how the industry pursues yield and manages complex liabilities. Jackson Financial, a prominent

Health insurance provider nib holdings limited is navigating a period of significant financial adjustment, flagging higher-than-expected one-time expenses for the first half of fiscal year 2026 that will impact its statutory bottom line. Despite these short-term hits, the company is stressing the

A fundamental disconnect has emerged between the fluid, instant-on nature of modern digital life and the rigid, often cumbersome processes of traditional insurance, creating a significant opportunity for disruption. Within the specialty insurance market, particularly travel, this gap is being