A significant and growing risk is jeopardizing the financial stability of Canadian homeowners and the insurance industry, not from a new and unforeseen threat, but from the absence of a critical tool: modern, accurate flood maps. As climate change continues to drive an increase in the frequency and severity of extreme weather events, Canada’s reliance on outdated and incomplete flood data has created a crisis of uncertainty. This situation is unique among G7 nations, leaving the country’s property market uniquely exposed to risks that are difficult to price, manage, or mitigate. The lack of a national, publicly accessible flood mapping system means that for millions of residents, the true danger of their location remains hidden until disaster strikes, threatening both public safety and the foundations of the national housing market. Without a clear picture of the peril, insurers, lenders, and homeowners are all operating in the dark, with potentially devastating financial consequences looming.

The High Stakes of Inadequate Data

A Market Operating in the Dark

The stability of any insurance market hinges on the ability to accurately assess and price risk, a function that is severely compromised by a lack of reliable data. For Canadian insurers, outdated flood maps make it nearly impossible to set fair and sustainable premiums or design appropriate coverage for overland flooding. This void of information creates a high-stakes guessing game where insurers face unanticipated, catastrophic claims that can destabilize their financial reserves. Consequently, the industry is forced into a defensive posture, which can manifest in several ways: skyrocketing premiums that place coverage out of reach for many, the introduction of significant gaps in coverage that leave homeowners exposed, or the complete withdrawal from regions deemed too high-risk to insure. This has profound downstream effects on homeowners, who may find themselves unable to secure mortgages as lenders become increasingly unwilling to finance properties with unquantifiable and uninsurable flood risk, effectively trapping residents in a cycle of financial vulnerability and amplifying the economic devastation of a natural disaster.

The Quebec Precedent and Public Reaction

The inherent tensions between risk disclosure and economic stability were starkly illustrated by recent efforts to update flood maps in Quebec. When preliminary new maps were released, they suggested that tens of thousands of properties in areas like Montreal could be reclassified into high-risk flood zones, sparking immediate and widespread concern among residents over plummeting property values and the future insurability of their homes. The public outcry highlighted the delicate balancing act governments face when communicating new risk information. In response, Quebec officials revised the initial figures and provided assurances that homeowners would not be forcibly relocated, yet they also implemented a crucial new policy: a prohibition on all new construction within the highest-risk areas. This case study serves as a critical example of the complex socio-economic challenges tied to mapping updates, demonstrating the need for transparent processes and clear communication to manage public anxiety while still implementing necessary, science-based regulations to prevent future losses.

From Individual Risk to Community Resilience

Concentrated Threats and Unintended Consequences

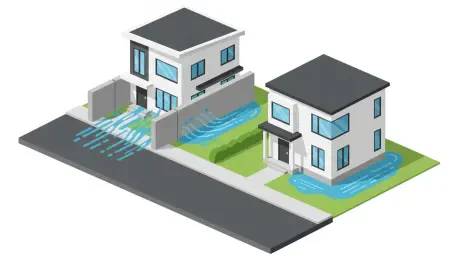

Research from the University of Waterloo’s Climate Risk Research Group has revealed a startling concentration of risk within Canada, showing that approximately 10% of homes are responsible for over 90% of all flood-related financial losses. This data strongly suggests that targeted mitigation efforts could be highly effective in reducing the nation’s overall exposure. However, experts caution against a purely property-level approach to flood defense, as it can lead to a cascade of unintended consequences. For instance, an individual homeowner might elevate their foundation or build a retaining wall, but these measures often work by simply redirecting the flow of water. This can inadvertently increase the flood risk for adjacent properties, effectively shifting the hazard from one neighbor to another rather than solving the underlying problem. Such outcomes underscore the critical need for a cohesive, community-level planning strategy. A system of transparent, modern flood maps is essential to guide this type of coordinated action, ensuring that mitigation efforts are holistic and do not create new, unforeseen dangers for others.

Charting a Course for Stability

The modernization of Canada’s flood mapping was a foundational step toward national resilience. The implementation of this critical infrastructure provided the clear, data-driven insights that had been missing for decades, enabling a host of positive changes. It allowed the insurance industry to finally stabilize, with insurers gaining the ability to accurately price risk, develop sustainable products, and confidently offer coverage in areas previously considered uninsurable. This, in turn, empowered homeowners with the knowledge they needed to take appropriate protective measures and make informed decisions. Furthermore, accurate maps guided effective government investment in large-scale, community-wide resilience projects, ensuring that public funds were directed toward the areas of greatest need. The future availability, affordability, and reliability of flood insurance across the country were ultimately secured by the nation’s commitment to embracing this essential tool.