The boardroom conversation around cybersecurity has fundamentally shifted from a technical IT discussion to a critical pillar of enterprise strategy, driven by the stark reality that the average cost of a data breach soared to nearly $5 million in 2024. This evolution reflects a growing understanding that digital risks are now inextricably linked to financial performance, operational continuity, and shareholder value. As organizations navigate an increasingly complex digital landscape, the responsibility for cyber resilience no longer rests solely with the CISO but has become a core fiduciary duty of the board itself. Directors are now expected to demonstrate not just awareness but a sophisticated understanding of the threat environment, demanding a new level of governance and strategic oversight to safeguard the enterprise against threats that can materialize from anywhere in a globally connected ecosystem. This paradigm shift requires a proactive, rather than reactive, posture, integrating cybersecurity into every major business decision.

The Expanding Digital Ecosystem and Its Inherent Risks

The modern enterprise’s greatest strength, its interconnectedness, has also become its most significant vulnerability. A substantial driver of corporate risk now originates from outside the organization’s direct control, with exposure through third parties and supply chains accounting for an alarming 30% of all data breaches. This figure, which doubled in a single year, underscores how deeply vulnerabilities can be embedded within the vast network of vendors, partners, and service providers that support core business functions. The seamless integration that fuels efficiency also creates a sprawling attack surface where a single weak link in the supply chain can trigger a catastrophic security failure. For board members, this reality complicates oversight, as traditional, inwardly focused security measures are no longer sufficient. Governance must now extend beyond the corporate perimeter to encompass the entire business ecosystem, demanding rigorous due diligence, continuous monitoring, and contractual safeguards for all external dependencies.

Artificial Intelligence presents a profound duality that leadership must carefully navigate, acting as both a powerful catalyst for business innovation and a formidable weapon for threat actors. While AI-driven tools enhance operational efficiency and unlock new revenue streams, they simultaneously provide adversaries with the means to automate and scale sophisticated attacks with unprecedented speed and precision. This technological arms race has exponentially expanded the corporate attack surface, yet a critical governance gap persists. A majority of organizations are deploying third-party AI solutions without conducting adequate security assessments, effectively integrating unaudited and potentially insecure technologies into their critical workflows. This oversight creates a blind spot in corporate risk management, as the internal and external threats posed by AI are not being systematically identified or mitigated. Boards must now question and verify the security posture of every AI tool being adopted, ensuring that the pursuit of innovation does not come at the cost of enterprise security.

A Shifting Landscape of Threats and Regulations

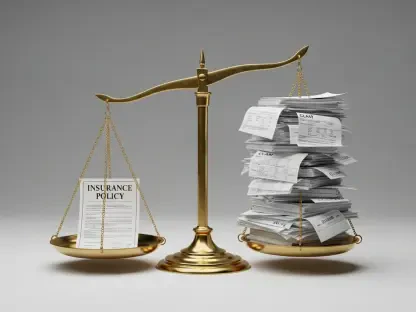

After a period of decline, ransomware has reemerged not as a more frequent threat, but as a far more severe one, capable of inflicting crippling financial damage. While the overall volume of attacks has stabilized, their impact has surged, evidenced by the dramatic rise in both average ransom payments and subsequent insurance claims throughout 2025. This evolution signifies a strategic shift by attackers, who are now targeting larger organizations with a greater capacity to pay and employing more sophisticated tactics, including double and triple extortion. For corporate leadership, this transforms ransomware from a disruptive IT problem into a direct threat to the company’s financial solvency. The decision of whether to pay a ransom has become a complex strategic calculation involving legal, ethical, and financial considerations that require board-level deliberation and a pre-defined incident response plan that accounts for such high-stakes scenarios.

In response to this heightened threat landscape, regulatory bodies and the cyber insurance market are concurrently tightening their requirements, placing greater pressure on corporate governance structures. New mandates from both the United States and the European Union have introduced stricter rules for cybersecurity governance, compelling boards to take a more active role and mandating faster and more transparent incident reporting. This regulatory push is mirrored by a hardening cyber insurance market. After a period of being buyer-friendly, insurers are now reacting to escalating losses by raising premiums and setting more stringent underwriting criteria. Companies seeking coverage must now demonstrate a mature security posture, including robust controls and a clear governance framework. This convergence of regulatory and market forces has created a new baseline for corporate responsibility, where inadequate cyber risk management can lead not only to direct financial losses from an attack but also to regulatory penalties and the inability to secure essential insurance protection.

A Retrospective on Board Preparedness

The challenges that defined the cybersecurity landscape provided a crucible for corporate leadership, and it became clear that effective governance was the ultimate differentiator. Boards that successfully navigated this period were those that had moved beyond passive oversight and had actively integrated cyber risk into their strategic decision-making frameworks. They had established clear lines of communication with their security leaders, demanded meaningful metrics over technical jargon, and had invested in resilience rather than just prevention. The most prepared organizations had understood that cybersecurity was not a singular event but a continuous process of adaptation in a dynamic threat environment. This proactive stance, which treated digital risk with the same seriousness as financial or operational risk, ultimately proved essential in protecting shareholder value and ensuring long-term business sustainability.