UnitedHealth Group, headquartered in Eden Prairie, Minnesota, is at the center of growing scrutiny as the Department of Justice (DOJ) investigates potential Medicare fraud linked to the company. This leading insurance giant faces accusations of inflating Medicare reimbursements through potentially inaccurate diagnostic practices, amplifying risk scores that boost payments. The DOJ has intensified its probe, reviewing in-home health assessments and chart audits by UnitedHealth-affiliated clinicians. These investigations extend to potential antitrust violations, scrutinizing how they might intertwine with Medicare billing practices. In response, UnitedHealth has taken proactive measures, initiating independent audits to ensure the accuracy of their diagnosis records while maintaining compliance with federal standards. Despite ongoing probes, the company confidently asserts the integrity of its procedures, fully cooperating with relevant authorities, and highlighting its commitment to ethical practices.

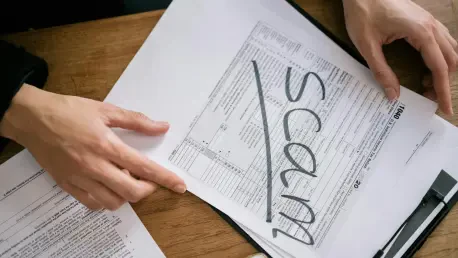

Scrutiny and Allegations

Examination of Medicare Fraud Practices

The DOJ’s investigation into UnitedHealth centers on the allegation that the insurer may have deliberately manipulated Medicare reimbursements by persuading healthcare providers to use questionable diagnostic methods. This practice could have led to artificially inflated risk scores, resulting in excessive Medicare payments to the company. UnitedHealth’s alleged actions, if proven, reflect a broader intent to leverage healthcare coding complexities for financial gain. This scrutiny sharpens the focus on the industry’s broader accountability issues, where companies might exploit systemic vulnerabilities to maximize profits at the expense of taxpayer funds. This development has galvanized regulatory bodies, urging closer examination of both the company’s practices and industry standards as a whole.

Moreover, these allegations reflect a potential systemic issue where insurers might be tempted to exploit intricate healthcare systems for their advantage. As the DOJ expands its investigation, it casts a wider net, possibly extending into areas concerning antitrust violations. The influence of these allegations poses not only immediate repercussions for UnitedHealth but also raises essential questions about industry ethics and transparency. Both the public and policymakers are now pressing insurance companies to reevaluate how risk assessments and Medicare reimbursements are calculated, demanding improved accountability and ethical compliance.

Response and Independent Audits

In the wake of these investigations, UnitedHealth has taken definitive steps to maintain transparency, initiating independent audits to meticulously review its diagnosis-recording processes. These audits represent a strategic approach to demonstrate adherence to federal guidelines and reaffirm the company’s dedication to lawful practices. By collaborating with external experts, UnitedHealth seeks to ensure procedural accuracy, mitigate discrepancies, and reinforce public trust. Such measures reflect the company’s strategic efforts to align with evolving regulatory expectations and manage reputational risks effectively.

UnitedHealth’s response underscores its commitment to maintaining ethical standards and protecting its operational credibility. Internally, the company is likely revisiting its training processes and compliance frameworks to prevent the recurrence of similar allegations. Publicly, UnitedHealth maintains steadfast confidence in its current protocols, emphasizing continuous cooperation with authorities to resolve these issues effectively. This proactive stance not only aims to safeguard UnitedHealth’s market position but also aligns with broader industry efforts to innovate and develop more standardized, transparent healthcare practices.

Broader Implications for the Healthcare Sector

Potential Consequences and Industry Impact

The DOJ’s ongoing investigation into UnitedHealth could lead to significant ramifications not only for the company but also for the broader healthcare landscape. The potential financial penalties UnitedHealth might face could be substantial, impacting its fiscal health and reputation. This development could spur broader dialogue on reform, prompting industry-wide efforts to overhaul current practices for improved transparency and ethical compliance. Furthermore, these events might catalyze a shift towards more robust regulatory frameworks to ensure taxpayer funds are safeguarded, minimizing opportunities for fraudulent activities to occur undetected.

The unfolding situation presents an opportunity for regulatory bodies and policymakers to advocate for reforms that enhance accountability in the sector. UnitedHealth’s case highlights the delicate balance between innovation in healthcare delivery and adherence to ethical standards, stressing the need for stakeholders to work collaboratively toward sustainable, equitable solutions. By addressing the root causes driving potential fraudulent activities, the healthcare industry can improve its integrity, enhancing service delivery while reducing the possibility of exploitation.

Future Considerations and Healthcare Reforms

The Department of Justice is investigating UnitedHealth over claims that the insurer may have manipulated Medicare reimbursements. Allegedly, they persuaded healthcare providers to employ questionable diagnostic methods, potentially inflating risk scores. This could have led to excessive Medicare payments, allowing UnitedHealth to financially benefit from the complex healthcare coding system. Should these allegations hold true, they point to a significant issue within the industry where companies might exploit systemic weaknesses for profit, using taxpayer funds.

This scrutiny has prompted regulatory bodies to delve deeper into UnitedHealth’s methodologies and industry practices. Such actions highlight a potential trend where insurers exploit intricate systems for advantage. The DOJ’s investigation may even extend to antitrust violations, which could have significant implications for UnitedHealth. These developments raise important questions about industry ethics and transparency, urging both the public and policymakers to pressure insurance companies to reassess risk assessments and Medicare reimbursement practices for better accountability and ethical standards.