A Market’s Soul on Trial

The Lloyd’s of London insurance market, an institution steeped in centuries of tradition and defined by its global influence, is once again facing a profound identity crisis that strikes at the very heart of its corporate character. The decision to reopen an investigation into the conduct of its former CEO has cast a harsh and unwelcome light on the cultural reforms painstakingly implemented since 2019. This is not merely an inquiry into one individual’s actions; it is a defining test of the market’s entire reformed identity. This analysis explores the critical gap between Lloyd’s publicly championed progress on culture and the stark realities of accountability at its highest levels. It will delve into whether the deep-seated “old boys’ club” mentality has truly been dismantled or if a two-tiered system of justice persists, ultimately questioning if the market’s new-found principles can withstand the ultimate stress test.

From Scandal to Reform: A Brief History of Lloyd’s Reckoning

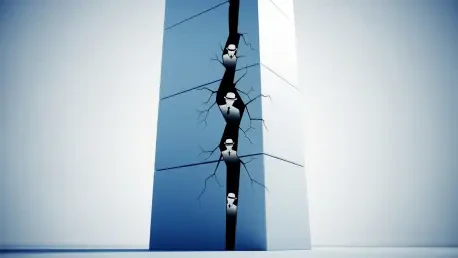

To understand the immense weight of the current moment, one must look back to the scandal that precipitated this era of change. In 2019, Lloyd’s was rocked by revelations of a toxic culture rife with sexual harassment and bullying, forcing the institution to confront uncomfortable truths about its inner workings and archaic norms. In response, a comprehensive reform agenda was launched with significant fanfare, introducing mandatory training programs, establishing better reporting mechanisms, and championing diversity initiatives meant to be more than mere “lip service.” Central to this ambitious overhaul was the UK’s Senior Management and Certification Regime (SM&CR), a stringent regulatory framework designed to enforce individual responsibility and ensure senior leaders are personally accountable for their conduct and the culture within their firms. These reforms were intended to be foundational, signaling a definitive break from the past and heralding a new era of transparency and integrity. The current investigation, however, threatens to expose these changes as a fragile veneer, forcing the market to question if the old power structures ever truly went away.

Probing the Cracks in the New Foundation

Is There One Rule for Them and Another for Us?

The most corrosive suspicion emerging from this episode is that Lloyd’s may operate a two-tiered system of justice, where the rules of conduct are applied differently depending on one’s position in the hierarchy. Culture specialists articulate this fear by asking a crucial question: Do governance structures function effectively for senior leadership, or are they exclusively for policing the rest of the organization? This probe gets to the heart of the matter. If accountability is not applied impartially and visibly, the trust that underpins any successful cultural transformation will rapidly evaporate. The perception that power protects power is a difficult one to shake, and a failure to handle this high-profile case with absolute transparency and rigor would fatally undermine years of progress. Such an outcome would confirm to many employees and market participants that the rules, however well-written, simply do not apply to those at the top, rendering the entire reform project hollow.

The Enduring Shadow of the “Old Boys’ Club”

Building on this concern is the lingering question of whether an informal, entrenched power structure still holds more sway than official policy and modern governance. The concept of an “old boys’ club,” where personal networks and established hierarchies override merit, due process, and professional conduct, is central to this crisis. Such a culture actively works against the psychological safety needed for individuals to raise concerns without fear of professional or personal reprisal. When long-standing relationships insulate leaders from scrutiny, a culture of silence prevails, allowing misconduct to fester unchecked and unreported. This incident serves as a critical litmus test for whether the recent reforms have genuinely dismantled this archaic system or simply forced it to operate more discreetly, still protecting its own outside the formal bounds of governance. The market is watching closely to see if procedure and principle will triumph over connection and influence.

The Regulatory Framework Under Maximum Pressure

Adding a layer of regulatory gravity to these cultural concerns is the role of the Senior Management and Certification Regime. As regulatory experts emphasize, SM&CR was created specifically to prevent accountability gaps in the financial services sector by pinning responsibility squarely on individuals in senior roles. The regime’s fundamental Conduct Rules—demanding that leaders “act with integrity,” “act with due skill, care and diligence,” and observe “proper standards of market conduct”—are not abstract ideals but enforceable principles with significant consequences for non-compliance. This situation places the SM&CR under an intense spotlight, testing whether its regulatory teeth are sharp enough to bite at the highest levels of one of the world’s most prominent financial institutions. This is not just a cultural dilemma; it is a direct challenge to a regulatory system designed precisely to ensure that no individual, regardless of their position or influence, is above the standard of conduct expected in the market.

The Future of Governance and Trust

An emerging trend suggests a market-wide anxiety is already taking hold, with industry observers noting a “huge uptick in accountability & ownership training requests for 2026.” This indicates a growing recognition that leadership responsibility is now under intense scrutiny, and firms are moving to mitigate their own governance risks. The outcome of this investigation will undoubtedly shape the future of governance at Lloyd’s and likely across the wider London market. A decisive, transparent, and impartial process could serve as a powerful catalyst to strengthen governance across the board, reinforcing the principles of SM&CR and demonstrating a genuine commitment to reform. Conversely, an opaque or lenient outcome would signal a catastrophic failure of the reform project, potentially triggering a crisis of confidence among employees, clients, and regulators that would be difficult to contain. The future of Lloyd’s will be defined not by the policies it has written but by its willingness to enforce them when it is most difficult to do so.

From Policy to Practice: Key Takeaways

The core takeaway from this situation is that the credibility of the entire Lloyd’s reform project hangs in the balance. The progress made since 2019, while commendable on paper, is being tested against its most difficult challenge: an allegation at the apex of power. For Lloyd’s and other legacy institutions navigating similar transformations, the path forward requires moving beyond mere policy implementation to unwavering and consistent enforcement. The key recommendations are clear: treat this moment not as a public relations crisis to be managed but as a catalyst to reinforce governance, ensure independent investigations are substantive and lead to decisive action, and foster genuine psychological safety where anyone can report misconduct without fear. For professionals, this serves as a potent reminder of the frameworks in place to protect them, while for leaders, it is a stark illustration of their deep personal accountability under regimes like SM&CR.

A Defining Moment for a Legacy Market

In conclusion, this analysis showed that Lloyd’s of London stood at a critical crossroads. The core themes of accountability, cultural integrity, and the dismantling of archaic power structures were revealed to have moved from theoretical discussions to a live, high-stakes test. How the market navigated this crisis was determined to have repercussions for years, impacting its global reputation and its ability to attract and retain the next generation of talent that expects and demands a fair and transparent workplace. This episode stripped away the rhetoric of reform, leaving one fundamental question that demanded an answer: were the rules and cultural expectations designed to ensure integrity applied with the same rigor at the top as they were everywhere else? The final verdict from the industry and its observers rested not on promises made, but on the impartial, decisive actions that Lloyd’s took next.