With a deep understanding of the intersection between insurance, technology, and risk, Simon Glairy is a leading voice in the Insurtech space. He specializes in how AI and modern platforms can help a historically slow-moving industry adapt to new consumer demands. Today, we delve into one of the most significant challenges facing insurers: the rise of Generation Z. Our conversation explores how this digitally native and economically cautious generation is forcing life and health insurers to rethink everything from product design and customer experience to the very core of their operational technology. We’ll discuss the urgent need for flexible, income-focused products, the practical steps to bridge the vast digital divide, and the strategies for building trust with a generation that values transparency and agility above all else.

With many younger people delaying homeownership and parenthood, how can insurers pivot from traditional milestone-based policies? What does a successful income protection product designed for Gen Z look like, and how could it evolve as their life circumstances change over time?

That’s the central challenge, isn’t it? The old playbook is obsolete. We see that 63% of people under 40 have no immediate plans to marry, and a staggering 84% aren’t planning on having children soon. So, a policy triggered by buying a home or starting a family simply won’t connect. The pivot must be towards income protection. A successful product for Gen Z is one that acts as a financial safety net for their most immediate asset: their ability to earn a living. It has to be flexible, something that feels relevant to their life now—renting, freelancing, or starting a small business. The real innovation lies in its adaptability. The product should be designed to seamlessly transition into more traditional life coverage when, or if, they decide to buy a house or get married down the road. It grows with them, rather than waiting for them to hit a specific, outdated milestone.

Young consumers expect personalized, data-driven recommendations, yet most insurers’ legacy systems can’t deliver them. Beyond a full system replacement, what are the first steps an insurer can take to bridge this gap? Can you detail how a tool like an AI-driven no-code platform helps?

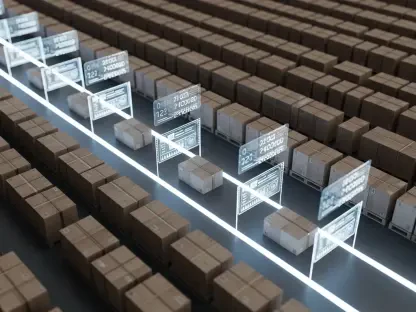

The gap is immense; you have 77% of younger consumers expecting comprehensive, data-driven advice, but only 16% of insurance companies can actually deliver it because of their inflexible systems. A full “rip and replace” of legacy technology is daunting and often financially unfeasible. The smartest first step is to implement a solution that works alongside existing systems, a sort of agility layer. This is where AI-driven no-code platforms come in. Think of them as a powerful toolkit that allows both business and IT teams to design, build, and launch new products rapidly, without having to overhaul the entire core infrastructure. It gives them the control to adjust coverage structures and craft those frictionless digital buying journeys that Gen Z expects. It’s a strategic, cost-effective way to start operating with the speed and personalization of a retail company, bridging that chasm without having to tear down the entire building first.

A significant number of young consumers would switch insurers for a better digital experience and clearer policies. What specific, practical steps can companies take to create this frictionless journey? Please share an example of how to make complex policy terms understandable on a mobile app.

The data is clear: 24% of young adults would switch for a personalized experience and another 20% for a better digital one. The key is to eliminate friction. This starts with a mobile-first approach where a quote can be generated in minutes, not days. It means using plain language instead of industry jargon. For example, to make policy terms understandable on an app, you could break them down into interactive, bite-sized modules. Instead of a 30-page PDF, imagine tapping on a term like “deductible” and a simple, animated video or a clear one-sentence explanation pops up. You could use sliders to show how changing coverage impacts the premium in real-time. Over a quarter of all consumers cited an inability to understand policy terms as a major point of dissatisfaction, so clarifying this isn’t just a nice-to-have; it’s a critical step to retaining customers.

Given Gen Z’s skepticism, born from events like the 2008 financial crisis and recent inflation, how can the industry rebuild trust? What messages about financial security will resonate most effectively with a generation that prioritizes immediate needs over long-term, traditional goals?

This generation’s financial worldview was forged in the fires of the Great Financial Crisis and hardened by recent inflation. They watched their families struggle, and that creates a deep-seated skepticism. To rebuild trust, the industry must stop selling abstract, far-off promises and start offering tangible, present-day value. The message needs to shift from “protecting your future legacy” to “securing your current lifestyle.” It’s about empowering them. The conversation should be around creating a financial safety net that protects them from an unexpected job loss or illness, ensuring they can still pay rent and cover their bills. It’s a message of stability and control in an uncertain world, which resonates far more than traditional talk of protecting assets they don’t yet have.

As insurers become more agile to attract Gen Z, what new operational challenges might they face? How can a company balance the need for retail-like agility for younger customers while maintaining the stability and traditional products expected by older generations?

The biggest operational challenge is managing a two-speed system. For decades, the industry’s slow, deliberate nature created stability, and older customers still value that. But to attract Gen Z, insurers must operate with retail-like agility. This means running a product development and customer service model for younger clients that is fast, digital, and iterative, while simultaneously maintaining the traditional, agent-driven model for older adults. The risk is creating internal silos or a disjointed brand experience. The key is to build flexibility into the core of your operations. The same underlying technology, like a modern no-code platform, should be capable of supporting both the rapid launch of an income protection product for a 25-year-old and the steady administration of a whole-life policy for a 60-year-old. It’s about creating a flexible ecosystem that can cater to different speeds and expectations without breaking.

What is your forecast for the life and health insurance industry over the next five to ten years?

My forecast is a story of divergence. We will see a clear split between the insurers who adapt and those who don’t. The winners will be those who fully embrace a flexible, dual-track approach—offering agile, income-focused solutions for Gen Z while continuing to serve their traditional base. They will leverage technology not just for efficiency but to create genuinely personalized and transparent customer journeys. Those who fail to move beyond their rigid legacy systems and milestone-based products will see their relevance, and their policy volumes, steadily decline as demographic and economic realities continue to shift. The next decade won’t just be about digital transformation; it will be about survival of the most adaptable.