In the fast-paced realm of specialty insurance, where risks are as unpredictable as a storm on the horizon, a staggering statistic looms large: only one in ten submissions typically bind, bogging down underwriters with inefficiencies and skyrocketing costs. This bottleneck in underwriting, particularly for complex risks like non-standard property or terrorism coverage, poses a critical challenge to an industry racing to keep up with digital transformation. Yet, amidst the surge of artificial intelligence and data-driven tools, a pressing question emerges—can algorithms alone navigate the murky waters of nuanced risk assessment, or is human insight the missing piece to unlock true potential?

The Critical Balance of Human and Machine in Underwriting

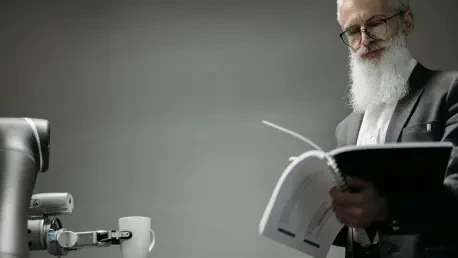

Striking a balance between human expertise and machine efficiency has become a cornerstone for revolutionizing insurance underwriting. In a field where decisions carry immense financial and societal weight, relying solely on algorithms risks overlooking subtle complexities that only seasoned professionals can discern. The integration of digital tools with human judgment offers a pathway to not just streamline processes but also enhance the quality of risk evaluation, setting a new standard for the industry.

This balance is not merely a theoretical ideal but a practical necessity. Specialty risks often defy standardized models, requiring a depth of understanding that transcends raw data. By combining the speed of technology with the intuition of experienced underwriters, the industry can address inefficiencies while maintaining the trust and accuracy that clients and regulators demand.

The High Stakes of Underwriting in a Digital Era

Underwriting complex risks has never been a simple task, and the digital age has only amplified the challenges. With AI and data enrichment reshaping the landscape, insurers face a double-edged sword of opportunity and risk. Inefficiencies persist—submissions take time and resources, often yielding minimal results—while regulatory bodies and public expectations push for transparency in automated decision-making systems, creating pressure to evolve rapidly.

Beyond operational hurdles, the stakes extend to trust and accountability. Automated systems, if left unchecked, can produce decisions that are difficult to explain or justify, especially in high-stakes scenarios like terrorism risk coverage. Integrating human oversight ensures that technology serves as a tool for empowerment rather than a source of opacity, addressing real concerns for insurers and policyholders alike.

Exploring the Power of Human-Algorithm Synergy

The collaboration between human insight and algorithmic tools creates a dynamic framework for underwriting that neither could achieve alone. Algorithms excel at triaging vast datasets, summarizing extensive claims files, and providing enriched information, allowing underwriters to assess more risks in less time. This efficiency frees up valuable hours for professionals to focus on strategic decision-making rather than repetitive tasks.

Yet, when it comes to complex or subjective risks, human judgment remains irreplaceable. Underwriters can spot inconsistencies in submissions or interpret a client’s risk perception through direct dialogue—skills beyond the reach of even the most advanced AI. Additionally, in market dynamics, smart follow strategies enable follow capacity to trust lead underwriters’ assessments, cutting down on redundant analysis and accelerating processes without sacrificing rigor.

Insights from the Trenches: Expert Perspectives

Veteran underwriter Daniel Prince, a leader at a firm pioneering digital solutions for underwriting, offers a grounded take on this hybrid approach. “Technology boosts productivity, but it can’t replicate the nuanced understanding of an experienced underwriter,” he notes. His perspective sheds light on AI’s limitations, particularly in grasping context or tone in risk evaluations, underscoring why human expertise must anchor digital tools.

Industry trends further support this view, with a growing emphasis on transparency to meet regulatory demands. Prince warns against opaque “black box” systems, advocating for explainable AI to ensure accountability. Real-world stories, such as underwriters uncovering hidden risks through personal client interactions, reinforce the unique value humans bring, adding depth and credibility to the argument for a balanced model.

Actionable Steps to Merge Human Expertise with Technology

Implementing a hybrid underwriting model requires deliberate strategies tailored to the field’s unique demands. Leveraging AI for routine tasks like data triage and summarization allows underwriters to prioritize high-value judgment calls. Identifying repetitive workflows and automating them can serve as a starting point for immediate efficiency gains.

Collaboration is equally vital—partnerships between underwriters and data engineers can address challenges with unstructured data, ensuring tools are practical and relevant. Regular cross-functional discussions help align priorities. Transparency in technology adoption, through explainable AI systems, prepares firms for regulatory scrutiny by documenting decision processes. Finally, adopting smart follow practices, where trust in lead underwriters minimizes duplicate efforts, streamlines market operations with clear guidelines on when to reassess risks.

Reflecting on a Path Forward

Looking back, the journey toward integrating human insight with algorithmic underwriting revealed a profound truth: technology, while powerful, thrives best as a partner to human expertise rather than a standalone solution. The stories of underwriters catching subtle risks through intuition and the push for transparent AI systems painted a picture of an industry learning to harmonize innovation with tradition. Each step taken showed that efficiency and accountability could coexist.

For the road ahead, the focus shifts to practical next steps—insurers are encouraged to pilot AI tools for mundane tasks while investing in training to sharpen underwriters’ strategic skills. Building stronger ties between technical teams and risk experts emerges as a priority to tackle data challenges. Above all, a commitment to explainable systems promises to safeguard trust, ensuring that as the digital landscape evolves, the human touch remains a guiding force in navigating uncertainty.