The financial security of millions of American households has been thrust into uncertainty as enhanced premium tax credits for Affordable Care Act (ACA) plans expired, creating a significant and immediate surge in healthcare costs that now stands at the forefront of national discourse. This development coincides with the release of the latest open enrollment data from the Centers for Medicare & Medicaid Services (CMS), which reveals a complex picture of the nation’s health insurance landscape. While enrollment remains robust, the slight dip from the previous year underscores a volatile environment where affordability is a paramount concern. The expiration of these crucial subsidies, which had shielded many from the full brunt of insurance premiums, has not only amplified the financial strain on individuals and families but has also ignited a contentious political debate. The central conflict revolves around the best path forward for American healthcare, a question that is becoming increasingly influential in shaping voter priorities ahead of the critical midterm elections. As policymakers grapple with solutions, the lived reality for many is a renewed and acute anxiety over the ability to afford essential medical care, transforming a policy debate into a deeply personal economic crisis.

The Shifting Landscape of ACA Enrollment

A Detailed Look at the Numbers

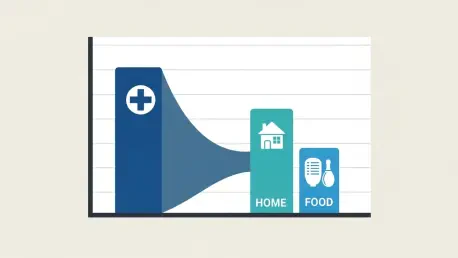

The conclusion of the ACA’s open enrollment period for the 2026 plan year has brought forth data that requires careful examination to understand the current state of the marketplace. The Centers for Medicare & Medicaid Services reported that approximately 23 million people secured coverage, a figure that, while substantial, represents a slight decrease from the nearly 24.2 million who enrolled in the prior year. This subtle downturn is significant, as it could indicate emerging affordability challenges or shifts in consumer behavior following major policy changes. Within the total, nearly 3.4 million enrollees are newcomers to the ACA marketplace, a testament to the ongoing need for the coverage it provides. However, the vast majority, 19.6 million individuals, are returning members, a group that is now directly confronting the financial consequences of expired subsidies. The distribution of these enrollments also highlights the dual nature of the system, with 15.8 million people selecting plans through the federally managed Healthcare.gov platform and another 7.2 million utilizing the exchanges operated by individual states. These figures, finalized after the January 15 deadline, serve as a crucial benchmark for evaluating the health and stability of the marketplace in a post-subsidy environment.

The demographic and geographic spread of these enrollment figures provides even greater insight into the national healthcare picture. The high number of returning members suggests a strong reliance on the ACA for continuous coverage, yet this is the very cohort most vulnerable to the recent premium hikes. An analysis of state-by-state data reveals variances in enrollment trends, with some state-based exchanges potentially mitigating the national downturn through more targeted outreach and state-level financial assistance programs. The number of new enrollees, while significant, is a metric that analysts will watch closely in the coming years. A sustained decrease in new sign-ups could signal that the entry-level cost of insurance, without the enhanced tax credits, is becoming a prohibitive barrier for the uninsured. This situation places immense pressure on the insurance market’s risk pool, as a lower influx of younger, healthier individuals could drive up costs for everyone. The data, therefore, is more than just a headcount; it is a direct reflection of the economic pressures shaping healthcare decisions for millions of Americans, from urban centers to rural communities, and it sets the stage for a critical analysis of the policy’s long-term sustainability.

The Political and Economic Fallout

The expiration of the enhanced premium tax credits on January 1 has become a major flashpoint in the national political arena, creating a stark divide between the major parties on how to address healthcare affordability. For Democrats, the immediate priority is the extension and potential enhancement of these subsidies, which they argue are essential for maintaining access to affordable care for working-class and middle-income families. They point to the millions of returning ACA members as evidence that the assistance was a critical lifeline, and its removal constitutes a direct and damaging financial blow to their constituents. This position is often framed as a defense of the foundational principles of the ACA, emphasizing the government’s role in ensuring healthcare is a right, not a privilege. The narrative centers on stories of individuals now facing untenable premium increases, forcing them to choose between their health and other essential expenses. Legislative efforts are being mobilized to retroactively restore the financial aid, positioning the debate as a clear choice between supporting families and allowing market forces to dictate access to care.

In sharp contrast, the Republican platform, which includes prominent voices like former President Donald Trump, advocates for a fundamental shift away from the subsidy-based model of the ACA. The opposition to extending the tax credits is rooted in a philosophy of market-based solutions and individual empowerment. The favored alternative involves promoting Health Savings Accounts (HSAs), which would allow consumers to save for medical expenses with tax-free dollars. Proponents of this approach argue that it fosters greater personal responsibility, increases price transparency, and introduces more competition into the healthcare market, which they believe will ultimately drive down costs more effectively than government subsidies. This strategy is presented as a way to dismantle what they view as an overly bureaucratic and inefficient system, replacing it with one that gives consumers more control and choice. The political debate is thus not merely about a single policy but represents a clash of two fundamentally different visions for the future of American healthcare, with one side prioritizing a government-supported safety net and the other championing individual financial tools and market dynamics.

Healthcare Costs as a Decisive Electoral Issue

Voter Sentiment and Economic Anxiety

The debate over healthcare affordability is not confined to legislative chambers; it is a dominant and deeply personal issue for American voters, poised to significantly influence the upcoming midterm elections. A recent poll conducted by KFF provides clear evidence of this trend, revealing that a majority of voters across the political spectrum identify healthcare costs as a critical factor in their decision-making process. The survey’s findings are stark: 30% of all adults surveyed stated that the failure to extend the ACA subsidies would have a “major impact” on their choice of candidates. This sentiment is not evenly distributed, with 54% of Democrats viewing the issue as highly influential, compared to 29% of independents and 12% of Republicans. This partisan divergence underscores the different ideological approaches to the role of government in healthcare but also highlights the broad-based concern among the electorate. The poll further illustrates that the issue’s salience is directly tied to personal financial strain. A staggering 55% of individuals reported that their personal healthcare costs had increased over the past year, creating a tangible link between policy decisions and household budgets.

This widespread economic anxiety is further amplified by concerns about future affordability, painting a picture of a populace on edge. The KFF poll found that two-thirds of Americans, or 66%, are either “very” or “somewhat” worried about being able to afford their healthcare expenses in the years to come. This pervasive fear transcends political affiliation and speaks to a fundamental insecurity regarding one of the most essential aspects of life. The termination of the ACA subsidies has transformed an abstract policy debate into a concrete financial reality for millions, likely intensifying these worries. For many families, the increased monthly premium is not a minor inconvenience but a significant budgetary challenge that could lead to delayed care, skipped prescriptions, or even the forfeiture of insurance coverage altogether. As the midterm elections approach, candidates will be forced to address this potent issue directly. The poll data suggests that voters are not just looking for abstract solutions but for tangible relief from the relentless pressure of rising medical costs, making healthcare affordability a powerful and potentially decisive factor at the ballot box.

A Reflection on Policy and Priorities

The intense focus on healthcare costs prompted a reevaluation of national priorities and the long-term efficacy of existing health policies. The expiration of the subsidies served as an inflection point, compelling a national conversation that moved beyond partisan talking points to address the fundamental sustainability of the American healthcare system. It became evident that while the Affordable Care Act had succeeded in expanding coverage to millions, its reliance on subsidies exposed a vulnerability to political shifts, leaving beneficiaries in a precarious position. The ensuing debate highlighted a growing consensus that simply restoring the previous status quo might not be a sufficient long-term solution. Discussions in policy circles began to explore more comprehensive reforms aimed at controlling the underlying drivers of healthcare costs, such as pharmaceutical pricing, hospital administrative overhead, and the complexities of insurance networks. The crisis underscored the need for policies that could deliver both accessibility and genuine, predictable affordability without being subject to constant legislative battles. This period was marked by a shift from a defensive posture of preserving existing mechanisms to a more forward-looking search for durable solutions that could withstand political volatility and provide lasting financial security for American families.