In an era where digital transactions and data handling dominate the financial landscape, small finance and insurance firms across the UK are grappling with an unprecedented wave of cyberattacks that threaten their very existence. Recent findings paint a stark picture, revealing that nearly half of these businesses—48% to be precise—have experienced a cyber breach within the past year, positioning this sector as the third-most targeted in the nation. The sensitive nature of client and financial data held by these firms makes them irresistible targets for cybercriminals employing tactics like phishing and invoice fraud. Beyond the immediate operational disruptions, the financial toll is staggering, with small and micro businesses collectively facing losses estimated at £921.2 million annually. This escalating crisis underscores a critical need for heightened awareness and robust defenses, setting the stage for a deeper exploration of the vulnerabilities, costs, and actionable strategies necessary to safeguard these vital enterprises.

Rising Vulnerability in the Finance Sector

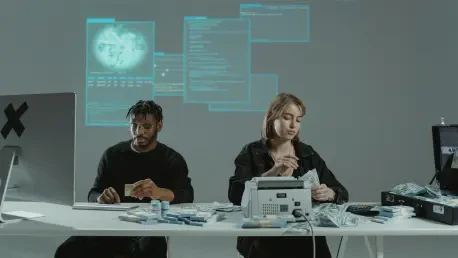

The finance and insurance sector’s unique position as a repository of sensitive information has made it a prime focus for cyber attackers, with small firms bearing the brunt of this digital onslaught. The high incidence of breaches—affecting nearly half of these businesses in just one year—reflects a troubling reality: cybercriminals are increasingly sophisticated in exploiting weaknesses. Phishing schemes, where attackers trick employees into revealing confidential information, and invoice fraud, which manipulates payment processes, are among the most common threats. These incidents not only disrupt operations but also erode client trust, a cornerstone of the industry. While the specific financial impact on small finance firms is estimated at £16.5 million, significantly lower than the national total for small businesses, the damage is still profound. This disparity may stem from industry-specific safeguards like insurance and regulatory protections, yet it highlights that no firm is entirely immune to the pervasive threat of cybercrime.

Compounding the issue is the dramatic rise in the cost of these cyberattacks, which has surged by over 90% for small and micro firms in the past 12 months, signaling a growing severity in both attack frequency and impact. Beyond the immediate financial losses, the hidden costs—such as downtime, legal fees, and reputational damage—often prove even more crippling. Small finance firms, despite benefiting from some protective measures, remain at high risk due to the sheer value of the data they manage. The National Cyber Security Centre has warned that such breaches threaten business survival, particularly for smaller entities with limited resources to recover. This escalating financial burden emphasizes the urgent need for proactive measures rather than reactive damage control. As attackers refine their methods, staying ahead requires not just awareness but a fundamental shift in how cybersecurity is prioritized within daily operations, ensuring that defenses evolve alongside the threats themselves.

Evolving Risks in Modern Work Environments

The transformation of workplace dynamics has introduced new layers of cyber risk for small finance firms, particularly with the rise of shared and flexible workspaces across the UK. These environments, while cost-effective and collaborative, often rely on communal networks and devices that can serve as entry points for cybercriminals. A single compromised device or unsecured connection in a shared space can jeopardize an entire network, exposing sensitive financial data to unauthorized access. This vulnerability is especially concerning for firms handling client transactions and personal information, where a breach can have far-reaching consequences. As remote and hybrid work models persist, the attack surface widens, making it imperative for businesses to reassess their security protocols. The challenge lies in balancing accessibility with protection, ensuring that convenience does not come at the expense of safety in an increasingly interconnected digital landscape.

Adding to these concerns is the technological challenge posed by outdated systems, such as the discontinuation of Microsoft’s security updates for Windows 10, which leaves millions of UK business users exposed. Small firms, often constrained by budget limitations, may delay upgrading their IT infrastructure, inadvertently creating vulnerabilities that attackers are quick to exploit. Operating on unsupported software is akin to leaving a door unlocked in a high-crime area, inviting threats like malware and ransomware. This issue underscores a broader need for modernization, where cybersecurity is woven into the fabric of business operations rather than treated as an optional add-on. Addressing these risks requires a commitment to regular system updates and a strategic approach to technology adoption. Without such measures, small finance firms risk falling further behind in a race against cybercriminals who are constantly adapting to exploit emerging weaknesses in the digital ecosystem.

Strategies for Building Cyber Resilience

Confronting the mounting cyber threats demands a multifaceted approach, with staff training emerging as a cornerstone of defense for small finance firms in the UK. Educating employees on recognizing phishing attempts, securing sensitive information, and adhering to best practices can significantly reduce the likelihood of successful attacks. Early detection systems also play a critical role, enabling businesses to identify and respond to threats before they escalate into full-blown breaches. Regular software updates are equally essential, ensuring that systems remain protected against known vulnerabilities. Experts emphasize that building cyber awareness is not a one-time effort but an ongoing process that must be embedded into company culture. By empowering staff with knowledge and tools, firms can create a human firewall that complements technical defenses, addressing one of the most common entry points for cyberattacks—human error.

Financial preparedness offers another vital layer of protection, helping small finance firms mitigate the economic fallout of a cyber incident. Maintaining a financial buffer in high-interest, instant-access savings accounts can provide the liquidity needed to cover unexpected losses, from system repairs to legal costs. Additionally, leveraging dedicated business bank accounts equipped with fraud prevention tools, such as Positive Pay controls, can help detect and block suspicious transactions before they result in significant damage. These measures, while not preventing attacks outright, ensure a quicker recovery and minimize long-term harm. The consensus among industry leaders is clear: no business, regardless of size, is immune to cyber threats, and a combination of technical safeguards and financial planning is essential. By adopting such proactive strategies, firms can bolster their resilience, transforming cybersecurity from a liability into a competitive advantage in an increasingly hostile digital environment.

Strengthening Defenses for the Long Term

Reflecting on the challenges faced, it becomes evident that small finance and insurance firms in the UK have encountered a relentless barrage of cyberattacks, with nearly half falling victim to breaches in a single year. The financial strain, contributing to a national loss nearing £1 billion for small businesses, has placed immense pressure on these firms, despite some mitigation through sector-specific safeguards. Evolving workplace risks and outdated technology have further intensified the threat, exposing critical vulnerabilities. However, the response through enhanced staff training, system updates, and financial buffers has begun to lay a foundation for resilience. Looking ahead, the focus must shift to sustained investment in cybersecurity infrastructure and fostering industry-wide collaboration to share best practices. Embracing innovative tools and maintaining vigilance will be crucial steps to ensure these businesses not only survive but thrive amidst the ever-growing tide of digital dangers.