From its unexpectedly modest headquarters in Traverse City, Michigan, a new kind of insurance brokerage has rapidly orchestrated an explosive rise, reshaping the competitive landscape of a centuries-old industry. Highstreet Insurance Partners, established just nine years ago, has transformed from a single local agency into a national powerhouse that now ranks among the top 25 insurance brokers in the United States. The company’s scale is staggering, boasting a workforce of over 3,000 employees spread across 350 offices in 36 states. After generating revenues exceeding $700 million in 2025, Highstreet is on a clear and deliberate path toward becoming a billion-dollar enterprise. This entire operation, a testament to a unique vision, is managed from the same northern Michigan city where its journey began with the foundational acquisition of Peterson McGregor & Associates, proving that a national giant can indeed grow from small-town roots.

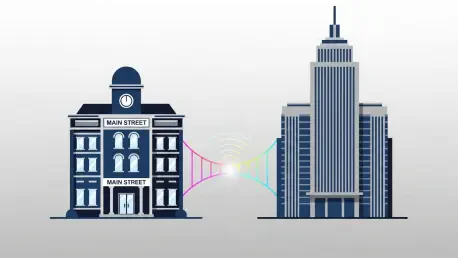

The Philosophy: Marrying Main Street with Wall Street

The “Mike O’Connor” Mindset

The foundational principle guiding Highstreet’s remarkable success is a unique business philosophy that founder and CEO Scott Wick has dubbed the “Mike O’Connor mindset.” This concept is not a boardroom invention but a direct consequence of Wick’s personal and professional evolution. He began his career in Chicago as a high-flying salesperson, driven by the relentless pursuit of large, prestigious accounts and the financial rewards they promised. This approach, however, proved to be unsustainable. The focus on transactions over relationships ultimately culminated in a significant professional setback, where he lost major clients due to a breakdown in relationship management. This failure served as a powerful catalyst, prompting a period of profound self-reflection where Wick re-evaluated his entire approach not only to his customers and professional connections but also to his personal life with friends and family, seeking a more meaningful and durable path to success.

During this introspective phase, Wick’s thoughts returned to the quintessential small-town insurance agent from his youth in Belleville, Wisconsin: Mike O’Connor. This figure was more than just an agent; he was a trusted pillar of the community, the first person anyone would call with an insurance question, no matter how small. O’Connor embodied reliability, familiarity, and a standard of impeccable customer service that seemed lost in the corporate world Wick inhabited. It was this powerful memory that sparked the central idea for Highstreet. Wick envisioned a new kind of insurance brokerage that could harness the power of national scale while preserving the intimate, trust-based service model of a local agent like Mike O’Connor. This philosophy would become the bedrock of a company designed to scale without losing its soul, aiming to offer the best of both worlds to its clients and partners.

The Hybrid Business Model in Action

Highstreet’s strategy materializes this philosophy by meticulously merging the core strengths of local agencies with the extensive capabilities of a national enterprise. The company’s growth model centers on acquiring successful, independent agencies located in small and mid-sized markets across the country. Crucially, the objective is not to absorb and erase these local brands but to preserve their deep community roots and the loyal, long-standing customer relationships they have painstakingly built over decades. Highstreet then empowers these local partners with a suite of sophisticated resources, deep industry expertise, and a comprehensive portfolio of solutions that are typically reserved for the largest national corporations. This approach enhances the value proposition for the agency, allowing it to serve its clients more completely and competitively without compromising the personal touch and local trust that made it successful in the first place.

This empowerment is the key to the model’s success. By providing access to a deep “solution bench,” Highstreet allows its partner agencies to transcend their traditional limitations. For example, an agency that has long specialized in personal lines insurance can suddenly offer its clients expert advice and top-tier products in complex areas like commercial lines, employee benefits, specialized wealth management, and emerging fields such as cyber liability. This allows them to service their existing “very sticky” customer base more holistically, protecting their client relationships from larger competitors while also creating new revenue streams. The fusion of Main Street service with Wall Street resources creates a formidable competitor in any market, delivering a level of service and expertise that neither a standalone local agency nor an impersonal national giant can typically match on their own.

Fueling Explosive Growth

A Disciplined Acquisition Strategy

Highstreet’s rapid national expansion is fueled by a deliberate, strategic, and exceptionally well-funded acquisition strategy that goes far beyond simple consolidation. The company’s aggressive growth has been made possible by significant investment from major financial players. A key partner in this journey is the Boston-based private equity firm Abry Partners, which holds a substantial 22% stake in the company, signaling strong institutional confidence in Highstreet’s model and leadership. This financial power was further solidified in August 2025, when the company secured a massive $550 million delayed draw term loan from a consortium led by Ares Capital. This immense capital infusion provides the necessary firepower for Highstreet to continue pursuing its growth targets with both speed and precision, enabling it to act decisively when the right partnership opportunities arise.

Despite the rapid pace of its acquisitions, Highstreet’s approach is the antithesis of indiscriminate. The company employs a sophisticated, data-driven methodology to guide its expansion, analyzing and scoring every county in the United States based on a variety of economic and demographic factors to identify ideal markets and agencies. The criteria for partnership are well-defined and rigorously applied. Highstreet is not interested in acquiring just any agency; its focus is squarely on finding partners that are still in a dynamic growth phase. The company explicitly avoids targeting agencies where the owner is simply looking for a “retirement strategy” or a quick exit. Instead, it seeks out ambitious leadership teams with a proven track record of strong organic growth who are eager to “double down” on their success by leveraging Highstreet’s vast resources to achieve their next level of expansion.

The Irresistible Offer for Independent Agencies

In an increasingly crowded market where consolidation is rampant, Highstreet manages to stand out by offering a compelling and differentiated value proposition that deeply resonates with independent agency owners. Wick’s personal history and his authentic “Mike O’Connor” philosophy create an immediate connection with leaders who have built their businesses on strong customer relationships and community focus. The primary allure for these agencies is the promise of gaining access to a deep “solution bench”—a vast array of products, services, and expertise that they could never hope to build on their own. This enhancement is transformative; a local agency that once specialized primarily in personal insurance can suddenly provide its clients with expert solutions in complex areas like commercial lines, employee benefits, wealth management, and cyber liability, becoming a true one-stop shop.

Beyond the expanded capabilities, joining the Highstreet network offers a profound shift in the professional lives of agency owners. They transition from the isolation of being a sole proprietor to becoming an integral part of a collaborative and supportive ecosystem of like-minded partners. This network fosters an environment of shared learning, encourages calculated risk-taking, and provides a safety net of collective wisdom. Armed with this collaborative power and an expanded toolkit, agency owners gain the confidence and the resources to pursue larger, more complex clients that were previously out of reach, from high-net-worth individuals with multiple properties to major local employers. The company’s diversified business portfolio—comprising approximately 35% personal insurance, 40% business/commercial insurance, and 20% employee benefits—is a direct reflection of this enhanced capability and expanded market potential.

The Small-Town Headquarters: Asset or Liability?

The decision to base a national powerhouse in Traverse City was a personal and professional one for Wick, who has consistently championed the location and its benefits. He cites the region’s exceptional quality of life, natural beauty, and vibrant outdoor culture as significant advantages for his nearly 90 local employees, fostering a positive work-life balance. Furthermore, he actively promotes a principle of supporting local businesses, engaging Traverse City vendors for services ranging from custom apparel to national event planning. This philosophy is encouraged across Highstreet’s nationwide network, with the goal of building more resilient and interconnected local communities. However, as the company’s trajectory continues upward, the charming small-town headquarters has presented significant challenges. Wick acknowledged the growing difficulty of operating a rapidly scaling national company from a smaller city, with the primary concern being talent attraction. The critical question now facing the leadership is whether Traverse City possesses the necessary infrastructure, resources, and, most importantly, the deep talent pool required to support the company’s long-term growth ambitions, particularly as it looks to consolidate its national management team of over 200 people. This evaluation has made the company’s long-term home a crucial strategic decision that will undoubtedly shape the next phase of its evolution.