In a landscape where federal agencies often push the boundaries of their authority, a pressing question emerges about the role of the Consumer Financial Protection Bureau (CFPB) in sectors traditionally governed by state oversight, particularly insurance. Recent legislative efforts have spotlighted

In a rapidly evolving financial landscape, The Hartford Insurance, ticker symbol HIG, stands at a crossroads where market confidence and uncertainty intersect, painting a complex picture for investors who must navigate these mixed signals. Recent data reveals a notable uptick in stock price,

Imagine a quiet night in a cozy UK home suddenly shattered by the roar of flames, only to realize that the smoke alarm, meant to be a lifesaver, is silent due to neglect or absence, leaving you and your family in grave danger. This scenario is far from rare, as recent research reveals a troubling

As the insurance industry navigates through a period of unprecedented technological change, the integration of artificial intelligence (AI) and blockchain stands out as a revolutionary force reshaping every facet of the sector. These innovations are not merely tools for efficiency but are

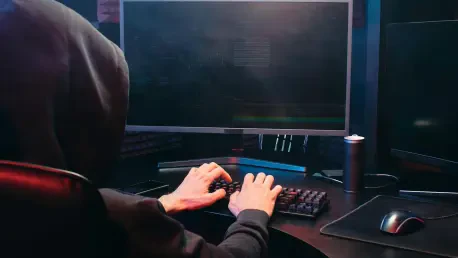

In an era where digital operations are the backbone of most enterprises, small and medium-sized businesses (SMBs) find themselves increasingly vulnerable to a barrage of cyber threats that can devastate their finances and operations. With a staggering statistic revealing that one in three SMBs

In a nation where insurance penetration lingers at a disheartening rate of less than 1% of GDP, as reported by the Insurance Regulatory Authority (IRA), the urgency for accessible risk protection has never been more evident. Uganda faces mounting challenges from economic uncertainties,

In a landscape where auto insurance costs can significantly impact household budgets, finding a provider that offers both affordability and reliability is a top priority for many drivers across the United States. A recent comprehensive analysis of over 10 million insurance quotes nationwide reveals

What happens when a life insurance policy, intended as a financial safeguard for a business loan, turns into a courtroom showdown? In a gripping legal dispute, First Internet Bank of Indiana has locked horns with American General Life Insurance Company over a $1.4 million payout, highlighting not

The insurance sector in the United States has recently found itself under siege by a relentless wave of cyberattacks, exposing critical vulnerabilities that threaten not only the companies but also the millions of customers who entrust them with sensitive personal information. These incidents have

In the intricate and rapidly evolving realm of miscellaneous professional liability (MPL) insurance, few figures command attention quite like Josh Daly, a seasoned public sector power broker with an uncanny ability to dissect and address the market's unique challenges. MPL insurance serves as a

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy