The daunting reality for many New Yorkers has long involved a difficult choice between purchasing a life-sustaining medical device or covering essential living expenses, a dilemma that has placed immense strain on countless families. In response to this growing crisis, the state has implemented a

The intricate process of converting a physical injury into a precise percentage for a workers' compensation claim is fraught with complexity, often leading to contentious disputes where the final payout hinges on the interpretation of dense medical guidelines. A landmark ruling from the Iowa Court

A company's most profound liability may no longer be found in its balance sheets or operational missteps, but in the very ideology that defines its existence. The modern digital landscape is forcing a reckoning within the insurance industry, where the calculus of risk is expanding far beyond

The United States property and casualty insurance landscape is currently undergoing a profound transformation, creating a sharply divided or two-tracked market that presents distinctly different challenges and opportunities for commercial insurance buyers. This pivotal transition is defined by a

The year 2025 proved to be a landmark period for China's insurance asset management industry, which staged a remarkable comeback defined by a powerful synergy of strategic market expansion, decisive policy intervention, and exceptionally strong investment performance. After a period of declining

The once-static lines on wildfire risk maps, primarily tools for firefighters and emergency planners, are now being redrawn with dynamic, high-resolution data that has captured the attention of corporate boardrooms and global investors. These advanced mapping technologies emerging in states like

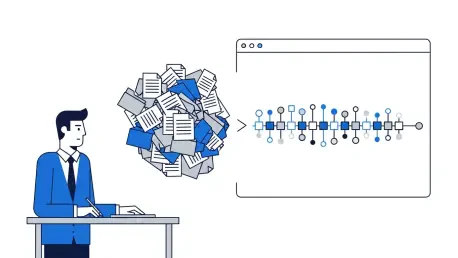

The modern insurance claims process is governed by a relentless influx of information, where adjusters are tasked with navigating a digital deluge of reports, invoices, estimates, and correspondence that arrives through countless channels. This constant stream of unstructured data creates a

The long-held benchmark for a successful retirement—simply amassing the largest possible nest egg—is proving to be an increasingly fragile strategy in the face of modern economic realities. Today's retirees navigate a complex landscape defined by longer lifespans, unpredictable market behavior, and

The proliferation of artificial intelligence across the business landscape has created a complex and unforeseen challenge for the traditional insurance industry, which now finds itself in a pivotal, transitional phase. Insurers are grappling with how to define, categorize, and underwrite a novel

The health insurance landscape in Saudi Arabia is undergoing a profound transformation, driven by regulatory shifts, rising customer expectations, and the relentless pressure of healthcare inflation. In this dynamic environment, the efficiency and transparency of claims processing have become

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy