A once-sleepy corner of the insurance market, customs bond underwriting, has experienced an unprecedented boom thanks to the aggressive tariff policies of the Trump administration. Insurers who specialize in this technical line of business, including major carriers like RLI, CNA, and Chubb, have

From its unexpectedly modest headquarters in Traverse City, Michigan, a new kind of insurance brokerage has rapidly orchestrated an explosive rise, reshaping the competitive landscape of a centuries-old industry. Highstreet Insurance Partners, established just nine years ago, has transformed from a

In the global effort to economically isolate Russia following its invasion of Ukraine, Western sanctions have been a primary weapon. The United Kingdom has positioned itself as a leader in this financial charge, vowing to cripple Moscow's war machine. However, a startling joint investigation by the

We're joined today by Simon Glairy, a recognized expert in insurance and Insurtech, whose work on risk management and regulatory policy offers a critical perspective on one of the most embattled insurance markets in the country. California's property insurance landscape is in turmoil, with major

Wall Street firms operate at the center of a profound paradox, constantly publishing a torrent of market forecasts, economic analyses, and investment reports while navigating one of the most heavily regulated and litigious industries on the planet. This raises a critical question: how do these

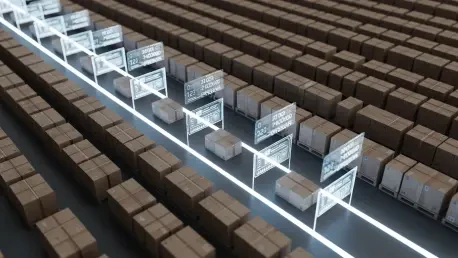

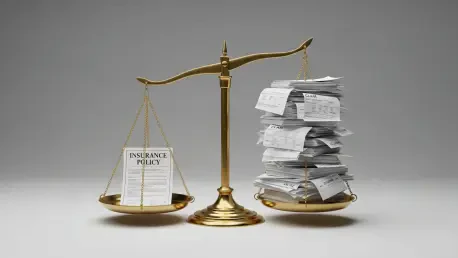

The long-standing pact between insurer and policyholder, built on the simple promise of financial restitution after a loss, is undergoing a fundamental re-evaluation in the face of modern complexities. For generations, the industry has operated primarily as a reactive force, pricing risk and

The relentless convergence of rising claims costs, capacity shortages, and inflationary pressures has created an exceptionally turbulent environment for brokers navigating the UK commercial motor insurance landscape. In this high-stakes climate, the agility and expertise of underwriting partners

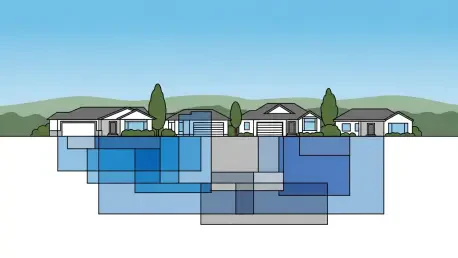

A comprehensive analysis of property owners reveals a critical and widening gap between the general awareness of escalating flood risks and any personal assessment of vulnerability, resulting in a significant lack of protective action. A recent study surveying over 1,500 high-net-worth property

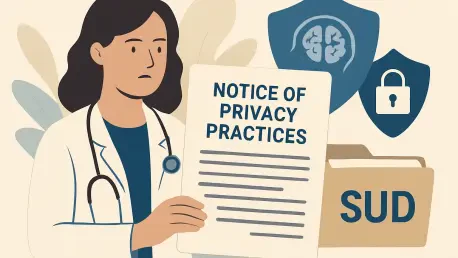

A significant federal compliance mandate for group health plans and other covered entities has come to a head, with a critical deadline of February 16, 2026, now passed, requiring updated HIPAA Notices of Privacy Practices (NPP) to be in place. This imperative stems from a multi-year regulatory

The world of philately, a hobby centered on the quiet study and collection of stamps, is rarely the backdrop for billion-dollar legal disputes. However, a lawsuit filed in the Eastern District of New York has thrust it into an intense spotlight, pitting insurer XL Specialty against Ideal Stamp

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy