Imagine pouring life savings into a dream home, only to watch the builder vanish mid-project, leaving behind unfinished walls and shattered hopes. This nightmare became reality for over 1,700 homeowners in Victoria following the collapse of Porter Davis Homes Group in March 2023, a builder

Imagine a family in Austin, scrambling to balance skyrocketing medical bills with a tight budget, only to realize they’ve missed the window to update their health insurance for 2026. In a region like Central Texas, where rapid population growth in areas such as the Hill Country fuels demand for

Imagine an industry often seen as steadfast and traditional, suddenly transformed by bold visionaries who dared to rewrite the rules. The insurance sector, a backbone of global economies, thrives not just on policies and premiums but on the shoulders of leaders who innovate, mentor, and adapt

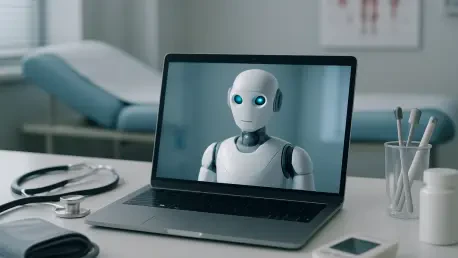

Imagine an insurance industry where piles of messy paperwork no longer bog down brokers, where policies are processed in hours instead of days, and where human expertise shines in strategic decision-making rather than mundane data entry. This isn’t a distant dream but a reality taking shape through

Two fires on tankers linked to sanctioned oil trades erupted within hours in the Black Sea, exposing how wartime hazards and opaque operators now intersect to create risks that stretch beyond normal playbooks for insurers and regulators. The episodes sharpened a debate that has simmered since the

A surge of capital into a direct-to-consumer insurer rarely shifts a regional market, yet Roojai’s $60 million Series C did exactly that by validating person-centric underwriting at scale, accelerating a move away from broker-led distribution, and placing data and transparency at the center of

Why Florida’s human-in-the-loop mandate matters now When automation reshaped claims in pursuit of speed and savings, few expected the next big upgrade would be a return to visible human judgment in the most consequential moments of a claim’s life cycle. Florida’s House Bill 527, filed on November

In a continent where millions remain vulnerable to financial shocks due to an insurance penetration rate of less than 3%, a groundbreaking initiative has emerged to reshape Africa’s risk protection landscape. FSD Africa recently announced a transformative $25–30 million Inclusive Insurtech

Imagine a world where a single click can cost a business millions. In 2025, this isn’t a far-fetched scenario but a chilling reality, as cybercriminals have already inflicted $16 billion in losses on companies worldwide, according to recent FBI Internet Crime Reports. This staggering figure,

In a market where motorists have long braced for days of waiting and repeated inspections just to validate a fender-bender, the promise of same-day clarity now reads less like a slogan and more like a plausible standard delivered by a smartphone. Lasaco Assurance Plc introduced FastClaim, an

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy