The relentless pursuit of higher yields has pushed many insurers to entrust their investment portfolios to specialist asset management firms, a move designed to leverage market expertise and unlock greater returns. This strategic delegation, however, masks a significant and often underestimated

As the deadline for filing legislation approaches, the initial flurry of over one hundred proposed bills offers a compelling preview of the political landscape and policy debates that will define Oklahoma's 2026 legislative session. While these early measures represent just a fraction of the

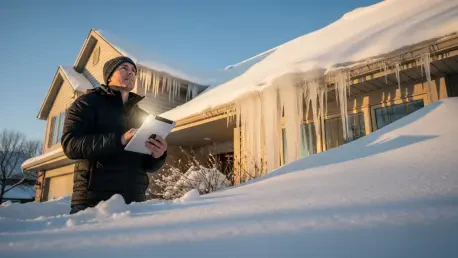

As winter casts its long shadow, the most significant financial risk for many households might not be from storm-damaged roofs but from the silent thawing of hundreds of dollars worth of festive food in a powerless freezer. This specific, seasonal threat highlights a growing trend in the insurance

Retirees across the nation are discovering that the reassurance of a homeowners insurance policy provides little comfort when the system designed to help them is critically backlogged, a situation that has become particularly acute this winter. What was once a straightforward process of filing a

In the fast-paced world of technology services, SHIFT Inc. has carved out a distinct and aggressive path to growth, building its investment narrative on a foundation of disciplined Mergers & Acquisitions (M&A) and strategic internal restructuring. The company's core strategy centers on compounding

A Revenue Windfall with Unintended Consequences The United Kingdom is on course to collect a record amount from its tax on insurance policies, a fiscal success story that is simultaneously sparking a fierce debate over public health. As government coffers swell, critics are increasingly questioning

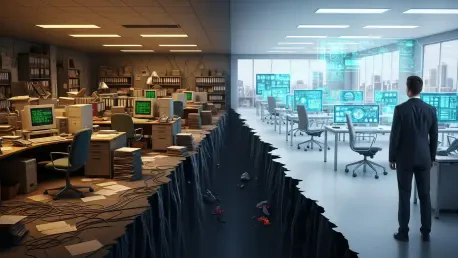

A recent industry poll reveals a startling reality within the managing general agent sector: exactly half of all MGAs are only just beginning their digital transformation journey, struggling with outdated technology stacks while their competitors accelerate into the future. This significant divide

The long-standing disconnect between what consumers believe their insurance covers and the stark reality they face during a claim has finally triggered a decisive regulatory reckoning from the United Kingdom's principal financial regulator. The Financial Conduct Authority’s (FCA) comprehensive

A profound breach of professional ethics has culminated in the conviction of a North London family, revealing how a former dentist, already barred from practice, orchestrated a sophisticated insurance fraud scheme from within her own clinic. The operation, which involved her two children, siphoned

The insurance industry is currently channeling immense capital into artificial intelligence, yet many executives cannot confidently answer whether these significant investments are building future-proof assets or simply expensive, high-tech liabilities. This wave of technological adoption promises

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy