In the fast-evolving landscape of insurance, Simon Glairy is a standout expert, particularly in harnessing AI for risk management in Insurtech. Today, we delve into an intriguing survey from Insurity that highlights generational shifts in digital expectations within the insurance sector. What

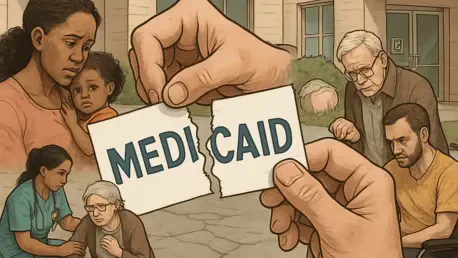

The implications of President Donald Trump's recent tax legislation, known as the "One Big Beautiful Bill," extend far beyond its financial ramifications. A central point of concern is its potential to leave millions without health coverage, notably affecting Medicaid, the vital public health

The Latin American (LatAm) insurtech sector's recent trajectory signifies a remarkable transformation after a significant downturn just last year. Bolstered by increasing investor confidence, the industry has witnessed an impressive surge in funding, particularly in Brazil, which continues to lead

The landscape of the captive insurance industry is undergoing significant transformation as regulatory pressures intensify, especially with the United States Internal Revenue Service (IRS) sharpening its focus on micro-captive insurance companies. These companies serve as strategic vehicles for

Emerging technologies often challenge the status quo, seeking to improve efficiency and transform industries. A perfect example is Agentic AI with its potential to revolutionize the insurance sector. In just four weeks, Zurich's Agentic AI Hyper Challenge attracted over 1,000 participants,

In the realm of insurance litigation, a recent ruling by the Vermont Supreme Court has set a precedent in determining the extent to which attorney fees can be claimed in multi-party settlements. Simon Glairy, an expert in insurance and Insurtech, offers insights into the implications of this

In a financial landscape continuously seeking innovation, the emergence of 1823 Partners (US) LLC marks a significant development. With a firm dedication to insurance-first investment strategies, the company's inception provides a fresh perspective on asset management. Founded by industry veterans

Imagine the vast networks of digital information crisscrossing the globe, influencing every aspect of modern life. As these networks expand, the threats they face have grown in number and complexity, creating a pressing concern for both businesses and individuals. In this landscape, Zurich

In an era marked by economic volatility and unprecedented challenges, independent insurance agencies are showcasing remarkable resilience. Despite facing declining market shares, increased claims, and stiff competition, these agencies have demonstrated an impressive capacity for adaptability. This

Peach State Health Plan (PSHP) has embarked on a transformative journey by investing $27.7 million to enhance Medicaid benefits, a significant financial commitment geared towards promoting healthier lives for thousands of individuals. Facilitated through the Value-Added Benefits (VABs), this

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy