In the rapidly evolving realm of insurance technology, Simon Glairy stands out as a leading voice, especially in the integration of AI in insurance operations. With his expertise rooted in risk management and AI-driven risk assessments, Simon has been a pivotal force in steering companies like

In the realm of healthcare, one of the prominent challenges we face today is the accessibility and affordability of fertility treatment and preservation services. U.S. Senators Cory Booker, Chuck Schumer, Tammy Duckworth, and Patty Murray, alongside Representative Rosa DeLauro, have reintroduced

Within the rapidly evolving sectors of insurance and annuities, companies are reimagining their strategies to better support financial advisors amid shifting market dynamics. Jackson National Life Insurance Company and Nationwide, two major industry players, have recently introduced significant

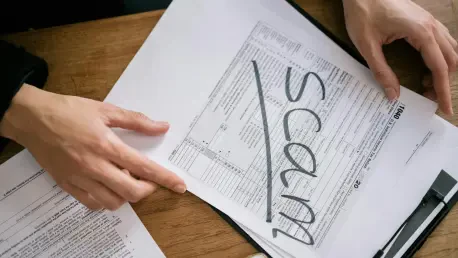

UnitedHealth Group, headquartered in Eden Prairie, Minnesota, is at the center of growing scrutiny as the Department of Justice (DOJ) investigates potential Medicare fraud linked to the company. This leading insurance giant faces accusations of inflating Medicare reimbursements through potentially

In the rapidly evolving landscape of insurance and claims management, strategic collaborations are critical to staying ahead of emerging challenges. Today, we sit down with Simon Glairy, a distinguished expert in insurance and Insurtech, to explore a significant new partnership between Arc Legal

The unsettling rise of staged car accidents in Florida represents a growing menace affecting drivers statewide, particularly in bustling urban centers like Tampa. A case involving a woman, colloquially referred to as Snooks, who believes she narrowly avoided an insurance scam, sheds light on this

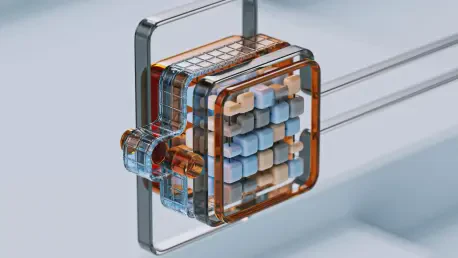

In the ever-evolving landscape of technology-driven solutions, Perfios.ai has made a significant impact with its new Generative AI-Powered Intelligence Stack designed specifically for the Banking, Financial Services, and Insurance (BFSI) sectors. The launch has sparked a wave of interest as it

In a rapidly advancing technological landscape, the automotive sector faces the challenge of aligning insurance models with the evolving needs of electric and autonomous vehicles. The Plan Group's (TPG) new division, eavi, symbolizes a pioneering attempt to bridge these gaps, offering bespoke

Motorists around the world are increasingly facing a deceptive and dangerous form of insurance fraud, known as the ghost accident scam. This alarming scam not only threatens the financial stability of drivers but also places their safety in jeopardy. Fraudsters engaged in this deceitful practice

The legal landscape surrounding underinsured motorist (UIM) benefits within commercial auto policies has seen increased scrutiny and complexity. This attention is largely driven by recent legal cases that illuminate the disparities between personal and commercial policy provisions, particularly in

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy