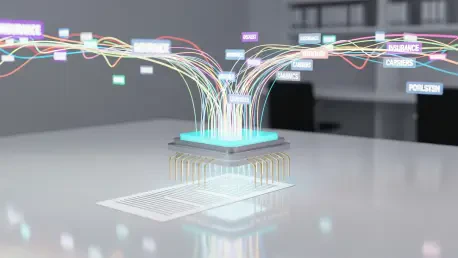

In today's fast-evolving market, artificial intelligence has transitioned from a futuristic concept into a tangible, accessible tool for small businesses. The promise of heightened efficiency, reduced costs, and data-driven insights is compelling, offering a chance to level the playing field

In a landscape where independent insurance brokerages are increasingly absorbed by larger entities, one specialty firm is not only resisting the trend but is strategically positioning its independence as its primary asset for future growth. The recent appointment of Matthew B. Gough as Chief

In an increasingly digitized world, the line between a cyber incident and a physical catastrophe has become dangerously blurred, leaving businesses to grapple with a new and ambiguous class of risk that traditional insurance policies were never designed to cover. The specter of a malicious code

In a decisive move to enhance its responsiveness and strategic focus, the Association of British Insurers (ABI) has initiated a fundamental restructuring of its governance framework, designed to decentralize authority and place its members at the forefront of policy development. This significant

A legislative proposal moving through the Florida House aims to cut regulatory red tape for homeowners undertaking small-scale improvement projects, but critics are sounding the alarm about potential long-term consequences for construction quality and the state's already volatile insurance market.

Behind the scenes of many high-stakes lawsuits, a burgeoning and often clandestine industry known as third-party litigation financing is quietly reshaping the dynamics of civil justice by allowing outside investors to fund legal battles in exchange for a portion of the settlement. Now, Florida

The traditionally calm and profitable waters of Directors and Officers (D&O) liability insurance for venture capital firms are now churning with unprecedented volatility, transforming what was once a benign risk into a significant and growing financial threat. For years, VCs were the darlings of

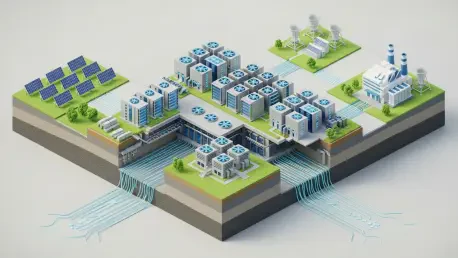

The relentless expansion of data consumption, cloud computing, and artificial intelligence has triggered an unprecedented demand for digital infrastructure, creating a highly complex and interconnected ecosystem where conventional, siloed risk management strategies are proving inadequate. To

The global digital economy's insatiable appetite for data, supercharged by the explosive growth of artificial intelligence, rests upon the silent, humming infrastructure of data centers. These facilities have evolved far beyond mere digital storage units; they are now the critical arteries of

The insurance industry has long been constrained by a persistent operational bottleneck that has stifled growth and consumed countless hours of manual labor, specifically the tedious and error-prone process of generating quotes for potential clients. SUPERAGENT AI, Inc. has officially announced a

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy