In an era where data overwhelms traditional systems, the insurance industry faces a staggering challenge: processing claims and managing policies with speed and precision while meeting rising customer expectations. With billions of data points generated annually from policies, claims, and customer

In an age where a phone’s ring can feel like an intrusion, millions of Americans are finding their patience tested by relentless robocalls, and the frustration is palpable. Picture this: a quiet evening at home, only to be interrupted by an automated voice pitching insurance deals you never asked

Setting the Stage for Digital Transformation in Insurance Payments In an era where efficiency dictates market success, the insurance industry grapples with outdated payment systems that frustrate policyholders and burden carriers with high operational costs, as evidenced by the staggering statistic

What happens when the promise of faster, cheaper, and greener construction collides with the hard reality of risk? Across the globe, developers are embracing innovative building techniques—mass timber, modular manufacturing, and even robotics—hoping to revolutionize an industry plagued by delays

In the bustling landscape of modern mobility, the carshare industry stands as a transformative force, reshaping how people access transportation in urban centers across the United States. With millions of users opting for shared vehicles over traditional ownership, the sector has witnessed

In a world where financial uncertainty looms larger than ever, consider a family blindsided by a sudden medical emergency, with bills piling up and no safety net to catch them, a scenario far from rare as millions of Americans grapple with unexpected costs that threaten their stability. Life

In the rapidly evolving landscape of medical innovation, gene therapies have emerged as a groundbreaking solution, offering the potential to cure conditions once deemed untreatable in the United States, symbolizing a new era of hope for countless patients. These therapies, meticulously evaluated

In the picturesque state of Connecticut, where historic homes and coastal charm define much of the landscape, a quiet concern is brewing among homeowners and insurers alike about the future of insurance affordability. Recent data and trends suggest that while the state currently enjoys mid-range

In an industry as vital and complex as trucking, where safety, efficiency, and cost management are paramount, artificial intelligence (AI) is emerging as a transformative force in insurance underwriting. This technology is not just tweaking existing systems but fundamentally reshaping how insurers

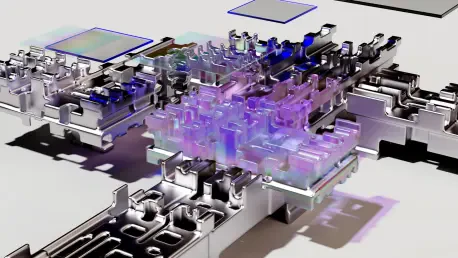

In an era where digital transformation dictates the pace of success in the insurance industry, BriteCore, a San Mateo, CA-based leader in property and casualty insurance solutions, is setting a new standard with its latest cloud-native platform updates announced on September 29, 2025. Targeting

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy