In the heart of Nigeria’s democratic process, National Youth Service Corps (NYSC) members stand as vital cogs, ensuring the smooth operation of elections as ad-hoc staff under the Independent National Electoral Commission (INEC). Despite their indispensable role at polling units across the nation,

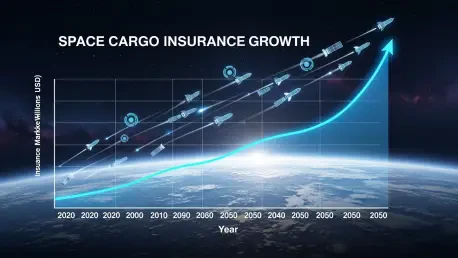

The space industry is soaring into uncharted territory, and as it expands, the need for specialized insurance to shield against the astronomical risks of satellite launches, cargo transport, and deep-space missions has never been more critical. Starting from a market value of USD 2.35 billion in

Overview of California’s Insurance Market Crisis California’s insurance market, a cornerstone of the state’s economic framework, stands at a critical juncture, grappling with unprecedented challenges that threaten stability across multiple sectors and impact industries from real estate to

In the fast-paced world of life and health insurance, a staggering 86% of independent agents cite compensation as the single most critical factor in deciding where to place their business, revealing a deep insight into the fierce competition among insurers to attract top talent. Compensation isn’t

The recent failure of a homeowners' insurance regulation bill in Illinois is more than a local political story. It is a critical flashpoint in a national debate over how to price risk in an era of unprecedented volatility. While lawmakers and insurers clashed over rate-setting authority, the

Every year, the United States faces an overwhelming financial challenge as fraudulent insurance claims soar past the $1.5 billion mark, hitting a staggering $1.74 billion in 2024, according to data from the Insurance Information Institute (III). This isn’t just a statistic—it’s a pervasive issue

In an era where digital transformation drives business at an unprecedented pace, the specter of cyber threats looms large over industries handling sensitive data and high-value transactions, particularly in private equity (PE) and venture capital (VC). These sectors, often entrusted with vast

The insurance industry is undergoing a seismic shift on a global scale, driven by the remarkable capabilities of artificial intelligence (AI) and sophisticated digital tools that are fundamentally changing how companies connect with their customers. No longer confined to the era of generic policies

Overview of a Critical Industry Safeguard In an era where unexpected disruptions can cripple even the most stable office-based businesses, consider the scenario of a legal firm in a bustling urban center forced to shut its doors due to a devastating flood, losing billable hours and client trust

In a striking turn of events that has sent ripples through the global insurance industry, Lloyd’s of London, a cornerstone of the market, finds itself at the center of a high-profile investigation involving John Neal, its former CEO, over allegations of an inappropriate workplace relationship. This

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy